The argument that the United States and China are on their way to soon reducing, or even eliminating, the trade gap between them has caused quite a stir in both the media and the blogosphere.

The discussion was sparked by a paper that Martin Feldstein, an economist at Harvard, presented earlier this month at the annual meeting of the American Economic Association. He explained that since consumers in the United States are starting to save more, and Chinese consumers possibly starting to save less, underlying trade imbalances could vanish. “It is not hard to imagine that a few years from now the current account imbalances of the U.S. and China will be very much smaller than they are today or even totally gone,” he wrote.

Not everyone who comments on Mr. Feldstein’s argument actually understands it. Many are confused by a common fallacy — though this is not a trap Mr. Feldstein has fallen into. To expose it, let’s first look at why China’s current yuan policy is a problem for the world.

Most people know that a trade deficit results from a country’s spending more than it earns. Some people then draw the conclusion, “Well, given that the problem is all about spending imbalances, exchange-rate policy has nothing to do with it.”

So let’s imagine that America and China are the only two countries in the world. Imagine that, as consumer habits change, American spending falls by $400 billion while Chinese spending rises by $400 billion. The trade imbalance is gone, right? No, it’s not that easy.

If Americans cut their spending by $400 billion, most of that reduction — say, 75 percent — will come from reduced spending on American-produced goods and services. Why? Because even that Chinese-made pair of pajamas an American buys at Wal-Mart has a lot of value added in distribution and retailing in the United States. So that means about $300 billion in reduced demand for American output, $100 billion in reduced demand for Chinese output. Meanwhile, a much smaller fraction — say, 15 percent, or $60 billion — of that extra Chinese spending will affect American goods.

So in total, we’re talking about a $240 billion net drop in spending on goods and services in the United States; correspondingly, we’re talking about a $240 billion rise in demand for Chinese goods and services. Overall, the whole spending shift produces a depressed economy in America and major inflationary pressures in China.

What’s needed is something to make both American and Chinese consumers switch some of their spending toward American goods — something like a rise in the dollar value of the yuan, which would make Chinese goods relatively more expensive.

Let Truthout send our best stories to your inbox every day, for free.

There is another way to achieve the same result: a combination of inflation in China and deflation in the United States. But what if China tries to head off inflation by raising interest rates while the United States finds itself unable to reduce rates, which have already reached the zero lower bound?

Then the result would be contractionary for the world as a whole.

Any resemblance between this scenario and real life is, of course, entirely intentional.

So Mr. Feldstein’s argument is actually supportive of yuan revaluation. He is not saying that it will not be necessary.

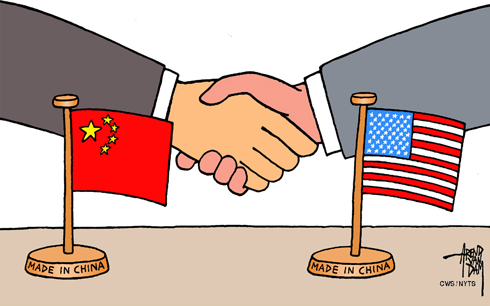

(Image: CartoonArts International / The New York Times Syndicate)

Backstory: Conflicting Predictions

Though many American economists and commentators have expressed misgivings about China’s growing economic influence, not everyone sees this as a negative situation for the dollar.

At a conference in Colorado on Jan. 6, Martin Feldstein, an economics professor at Harvard, presented an optimistic view, predicting that the trade deficit between the United States and China (which was $38.3 billion in November, the latest figure available) could rebalance within a few years, reaching an equilibrium more favorable to the United States.

He argues that the devalued dollar, uptick in precautionary household savings and the government’s willingness to cut spending are all keeping inflation in check.

And as prices in China continue to rise, the real value of the yuan in relation to the dollar will rise, forcing a natural adjustment in the trade deficit. China should ratchet up its domestic spending, Mr. Feldstein advises, which would strengthen the yuan, narrow the trade gap further and foster economic stability in both nations.

However, many other economists and pundits disagree about the prospects for trade rebalancing. Some point out that it seems unlikely Congress will succeed in cutting spending, as Democrats and Republicans continue to clash over tax cuts and health-care reform. Others look beyond fiscal policies and warn that the United States cannot keep up with China’s growth, pointing out that by 2020 the size of China’s economy could rival that of the United States.

Economist Simon Johnson of the Massachusetts Institute of Technology has taken one of the most pessimistic positions with regard to this issue. At the same economic conference where Mr. Feldstein spoke, Mr. Johnson told a panel that within the next two decades, the yuan would replace the dollar as the world’s reserve currency because the damage done to the United States’ economy by the economic downturn was irreversible.

© 2010 The New York Times Company

Truthout has licensed this content. It may not be reproduced by any other source and is not covered by our Creative Commons license.

Paul Krugman joined The New York Times in 1999 as a columnist on the Op-Ed page and continues as a professor of economics and international affairs at Princeton University. He was awarded the Nobel in economic science in 2008.

Mr Krugman is the author or editor of 20 books and more than 200 papers in professional journals and edited volumes, including “The Return of Depression Economics” (2008) and “The Conscience of a Liberal” (2007).

Copyright 2010 The New York Times.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $22,000 by the end of today. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.