The pace of growth slowed sharply to 142,000 in August. Coupled with downward revisions to June’s data, this brings the average rate of job growth over the last three months to 207,000. Between March and June, the economy added jobs at a monthly rate of 267,000.

The falloff was widespread across industries. Manufacturing employment was flat after adding an average of 21,000 jobs a month in the prior three months. Retail employment fell by 8,400 in August after adding an average of 22,700 jobs in the prior three months. Transportation added just 1,200 jobs, down from an average of 16,400 in the prior three months. Job growth in professional and technical services (16,800) and restaurants (21,500) was also somewhat weaker than its recent pace.

In percentage terms, the motion pictures sector continues to be a big job loser, shedding 6,000 jobs in August — 2.0 percent of total employment. Jobs in the sector have fallen by 18.6 percent over the last two years. On the opposite side, health care added 34,000 jobs, the third biggest rise in the last five years. This is likely an anomaly that will be offset by weaker growth in the months ahead.

There is little evidence that the strengthening labor market is leading to wage pressures. Over the last three months, the average hourly wage has risen at a 2.3 percent annual rate, virtually identical to the 2.1 percent rate over the last year. In fact, almost no sectors show evidence of substantial wage growth. Only three sectors — mining, information, and leisure and hospitality — have seen hourly wage growth in excess of 2.5 percent over the last year. A 3.5 percent rate of wage growth is consistent with the Federal Reserve’s 2.0 percent inflation target (assuming 1.5 percent productivity growth). Only mining at 4.1 percent and information at 3.8 percent cross this threshold.

On the household side there was little new in the August data. The unemployment rate edged down slightly to 6.1 percent, but the employment-to-population ratio (EPOP) remained stable at 59.0 percent.

By education level, college grads don’t seem to be faring well at this point in the recovery. Their unemployment edged up to 3.2 percent, while their EPOP fell 0.2 percentage points to 72.2 percent. Over the last year, their unemployment rate has fallen by just 0.3 percentage points, while the EPOP of college grads is actually down by 0.6 percentage points. By comparison, those with some college have seen a drop of 0.7 percentage points in their unemployment rate and a rise of 0.4 percentage points in their EPOP.

The unemployment duration measures all declined in August, with the share of long-term unemployed falling to 31.2 percent, the lowest level since June of 2009. By comparison, long-term unemployment accounted for more than 22 percent of unemployment from June 2003 to June 2004. The number of people involuntarily working part-time fell by 197,000 and now stands 562,000 below its year-ago level. Voluntary part-time employment is up 271,000 from its year-ago level, although down 152,000 from July.

Employment growth continues to be less skewed toward older workers. Workers over age 55 accounted for 108.2 percent of total employment growth in the first four years of the recovery. By contrast, they accounted for just 29.4 percent of employment growth over the last year. This is consistent with a scenario in which many older but pre-Medicare age workers no longer feel as much need to work now that they can get health care insurance through the exchanges. Workers in the 25-34 age group appear to be the gainers, accounting for 37.1 percent of employment growth over the last year.

While the slower pace of job growth in this report is a surprise to many analysts, the stronger rate in the first half of this year really was not consistent with the rate of GDP growth that we have seen recently or is generally forecast for the near future. If the economy is growing in a 2.5 percent range, then we should expect to see job growth of around 1.0 percent, or 1.4 million a year. Unless the economy grows far more rapidly than is general expected, we should expect to see job growth well under 200,000 a month.

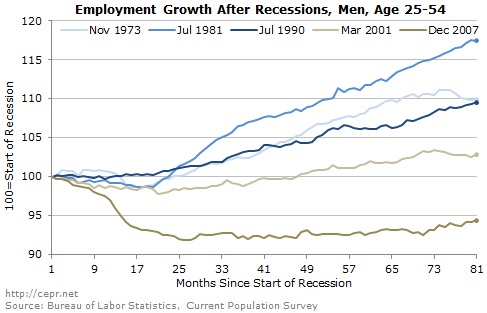

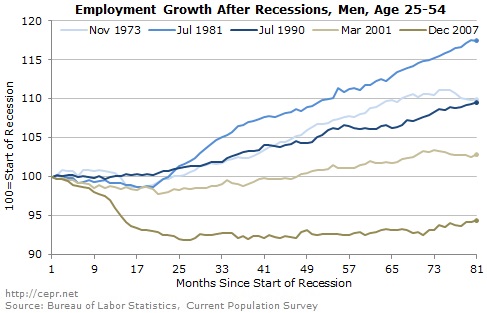

The remarkably weak GDP growth in this recovery is consistent with the extraordinarily weak job growth. While many have tried to explain the weakness on demographics, even if we restrict the focus to prime age men, employment is performing far worse than in prior recoveries.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $50,000 in the next 9 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.