Health spending continues its slower path, with an inflation rate of just 1.4 percent over the last year.

GDP grew at a higher than expected 3.5 percent annual rate in the third quarter. The biggest factors in this growth were a 16.0 percent increase in defense spending, which added 0.66 percentage points to growth; an 11.0 percent increase in the export of goods, which added 0.99 percentage points to growth; and a 2.4 percent decrease in the import of goods, which added 0.34 percentage points to growth. These three categories accounted for almost two full percentage points of the growth in the quarter.

In other categories, consumption grew at a modest 1.8 percent annual rate, while non-residential investment grew at a 5.5 percent rate. Housing grew at a 1.8 percent annual rate, while government spending outside of defense grew at just over a 1.0 percent rate. Inventories were a drag on growth, subtracting 0.57 percentage points.

Consumption spending was held down by spending on services, which rose at just a 1.1 percent annual rate. This compares to a 1.7 percent average growth rate in the years 2011-2013. Services account for two-thirds of consumption, so weaker growth in services will limit overall consumption growth.

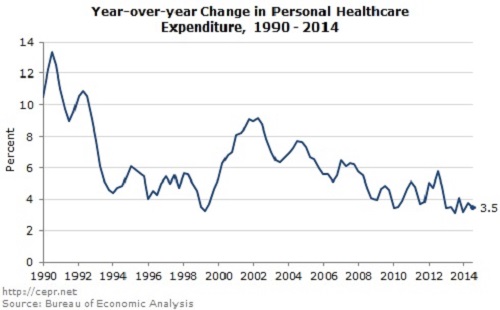

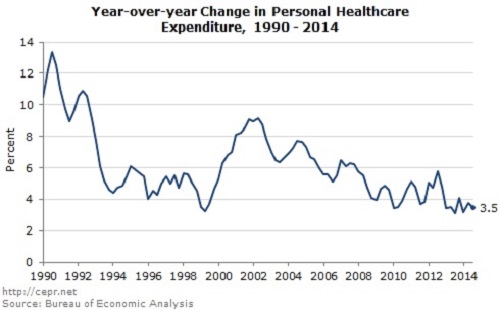

Within services, one of the factors depressing growth in the quarter was a 1.6 percent rate of decline in spending on housing and utilities. This reflects less electricity use due to a relatively mild summer. That will be reversed in coming quarters. The other major factor slowing spending is health services, which increased at just a 1.8 percent annual rate in the quarter. Both health care inflation and total spending have slowed sharply in recent years. Nominal spending in the third quarter is just 3.5 percent above the year-ago level. With real spending up by 2.1 percent, this implies a 1.4 percent inflation rate. It is difficult to determine the extent to which this slowdown can be attributed to the ACA, but clearly the predictions that costs would explode due to the extension of coverage have proven wrong.

The jump in defense spending is almost certainly an anomaly that will be reversed in future quarters. The last double-digit jump in defense spending was an 11.9 percent increase reported for the third quarter of 2012. The following quarter spending fell at a 20.1 percent annual rate.

The improvement in trade largely reflects a reduction in imports of oil. Lower oil prices and reduced oil imports free up money for other consumption. However, increased U.S. oil production may also be a factor contributing to the recent rise in the dollar. This will make U.S. goods less competitive and will be a drag on net exports in future quarters.

This report should further dampen any concerns about growing inflationary pressures. The overall GDP deflator grew at a 1.3 percent annual rate in the quarter and is up by 1.6 percent from its year-ago level. The core PCE deflator that the Fed targets grew at a 1.4 percent annual rate and is up 1.5 percent from its year-ago level.

Going forward, it is likely that GDP growth will be closer to 2.0 percent than 3.0 percent. The surge in defense spending will almost certainly be reversed in the next two quarters, creating a substantial drag on reported growth. Trade will also be more neutral, as we are not likely to see another comparable fall in imports. (There was an unusually large jump in the second quarter.) More normal utility use will provide somewhat of a boost to growth, but there is little reason to expect the pace of overall consumption growth to accelerate much. The saving rate is still relatively low at 5.5 percent (meaning consumption is high relative to income) and with wage growth modest, there is no reason to expect any large upticks in consumption spending. Housing construction may pick-up somewhat, but it is not likely to be a major contributor to demand growth nor is non-residential investment.

In short, we are likely to see the economy continuing to grow at a sluggish pace. With a potential growth rate in the range of 2.0-2.4 percent, the economy is making up little of the ground lost in the downturn.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. We have hours left to raise the $12,0000 still needed to ensure Truthout remains safe, strong, and free. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.