Elizabeth Warren is clearly getting on the Administration’s nerves.

The Massachusetts senator has come out forcefully against the misleadingly named trade deals, the TransPacific Partnership and its ugly sister, the TransAtlantic Trade and Investment Partnership. Mind you, these treaties are not about trade. Trade is already substantially liberalized and in keeping, only five of the 29 chapters of the TransPacific Partnership deal with tariffs.

What these pacts are primarily intended to do is strengthen intellectual property laws to help US software and entertainment companies, along with Big Pharma, increase their hefty profits, and to aid multinational by permitting the greatly increased use of secret, conflict-ridden arbitration panels that allow foreign investors to sue governments over laws that they contend reduced potential future profits. I am not making that up.

Warren focused on the so-called investor-state dispute settlement process in a Washington Post op-ed last week. We’ve discussed these panels in gory detail in previous posts.

That article led the White House to issue a “lady doth protest too much” rebuttal that we’ll shred shortly. But let’s first review the state of play.

The Administration had no luck in the last Congress getting so-called “fast track” authorization for the TPP due to widespread opposition. It wasn’t just that Majority Leader Harry Reid refused to table it in the Senate. John Boehner made it clear that he couldn’t get the votes in Republican-controlled House to pass it either. Over 200 representatives, including some Republicans, signed letters or otherwise voiced reservations about the trade deals, and another 30 to 40 were believed to be against it. Although the Administration has tried to claim otherwise, the opposition goes well beyond the small cohort of “progressives”.

Part of the reason for the Congressional revolt is that the Administration has made it impossible for Congress to review the drafts properly. But another is that even some conservatives are willing to come out against these agreements as pork for big multinationals. For instance, the right wing think tank Cato supported the Warren op-ed:

An important pillar of trade agreements is the concept of “national treatment,” which says that imports and foreign companies will be afforded treatment no different from that afforded domestic products and companies. The principle is a commitment to nondiscrimination. But ISDS turns national treatment on its head, giving privileges to foreign companies that are not available to domestic companies. If a U.S. natural gas company believes that the value of its assets has suffered on account of a new subsidy for solar panel producers, judicial recourse is available in the U.S. court system only. But for foreign companies, ISDS provides an additional adjudicatory option.

As a practical matter, investment is a risky proposition. Foreign investment is even more so. But that doesn’t mean special institutions should be created to protect MNCs from the consequences of their business decisions. Multinational companies are savvy and sophisticated enough to evaluate risk and determine whether the expected returns cover that risk. Among the risk factors is the strength of the rule of law in the prospective investment jurisdiction. MNCs may want assurances, but why should they be entitled to them? ISDS amounts to a subsidy to mitigate the risk of outsourcing. While outsourcing shouldn’t be denigrated, punished, or taxed – companies should be free to allocate their resources as they see fit – neither should it be subsidized.

The trade deals are coming up again for a fast track vote, perhaps as soon as this week. Warren’s focus on the investor panels has the potential to raise awareness of how dangerous they are and stir more voters to press their Congressmen to nix fast track authority. Here is the guts of her case against these tribunals:

ISDS would allow foreign companies to challenge U.S. laws — and potentially to pick up huge payouts from taxpayers — without ever stepping foot in a U.S. court. Here’s how it would work. Imagine that the United States bans a toxic chemical that is often added to gasoline because of its health and environmental consequences. If a foreign company that makes the toxic chemical opposes the law, it would normally have to challenge it in a U.S. court. But with ISDS, the company could skip the U.S. courts and go before an international panel of arbitrators. If the company won, the ruling couldn’t be challenged in U.S. courts, and the arbitration panel could require American taxpayers to cough up millions — and even billions — of dollars in damages.

If that seems shocking, buckle your seat belt. ISDS could lead to gigantic fines, but it wouldn’t employ independent judges. Instead, highly paid corporate lawyers would go back and forth between representing corporations one day and sitting in judgment the next. Maybe that makes sense in an arbitration between two corporations, but not in cases between corporations and governments. If you’re a lawyer looking to maintain or attract high-paying corporate clients, how likely are you to rule against those corporations when it’s your turn in the judge’s seat?

If the tilt toward giant corporations wasn’t clear enough, consider who would get to use this special court: only international investors, which are, by and large, big corporations. So if a Vietnamese company with U.S. operations wanted to challenge an increase in the U.S. minimum wage, it could use ISDS. But if an American labor union believed Vietnam was allowing Vietnamese companies to pay slave wages in violation of trade commitments, the union would have to make its case in the Vietnamese courts.

And what was the White House’s response? It was dishonest at a high level and in detail.

On a high level, it asserts that subordinating the jurisdiction of US courts to secret, undemocratically accountable arbitration panels and given them the power to fine the US government for its laws and regulations is not a loss of sovereignity. Help me.

Last week, Lambert flagged that the Administration can’t even get its story straight. The text states:

The reality is that ISDS does not and cannot require countries to change any law or regulation.

Looking more broadly, TPP will result in higher levels of labor and environmental protections in most TPP countries than they have today.

Not only are those two statements inconsistent, but extensive work by Public Citizen demonstrates that the claims are misleading.

Narrowly speaking, suing ex post facto to make a government pay a foreign investor for his future lost profits does not “require” a country to revamp its rules. But who are you kidding? The ISDS mechanism vitiates enforcement.

In addition, the claim that the TPP will strengthen environmental protection is spurious. Wikileaks published a draft of the environment chapter. From Professor Jane Kelsey of New Zealand’s analysis:

The most egregious threat to the environment is the investment chapter, in particular the prior consent by all countries except Australia to investor-state dispute settlement (ISDS). The vast majority of investment arbitrations under similar agreements involve natural resources, especially mining, and have resulted in billions of dollars of damages against governments for measures designed to protect the environment from harm caused by foreign corporations. The US is also demanding that contracts between investors and states that involve natural resources also have access to ISDS.

Moreover, notice how the White House claims is “ISDS does not and cannot require countries to change any law or regulation. ” as opposed to “the TPP does not and cannot”? That word choice was deliberate. Other provisions in the agreement explicitly require all signatories to conform their laws to the TPP. From Public Citizen’s analysis:

What is different with TAFTA [pending Trans Atlantic Free Trade Agreement] (and TPP) is the extent of “behind the border” agenda

• Typical boilerplate: “Each Member shall ensure the conformity of its laws, regulations and administrative procedures with its obligations as provided in the annexed Agreements.” …

• These rules are enforced by binding dispute resolution via foreign tribunals with ruling enforced by trade indefinite sanctions; No due process; No outside appeal. Countries must gut laws ruled against. Trade sanctions imposed…U.S. taxpayers must compensate foreign corporations.

• Permanence – no changes w/o consensus of all signatory countries. So, no room for progress, responses to emerging problems

• Starkly different from past of international trade between countries. This is diplomatic legislating of behind the border policies – but with trade negotiators not legislators or those who will live with results making the decisions.

• 3 private sector attorneys, unaccountable to any electorate, many of whom rotate between being “judges” & bringing cases for corps. against govts…Creates inherent conflicts of interest….

• Tribunals operate behind closed doors – lack basic due process

• Absolute tribunal discretion to set damages, compound interest, allocate costs

• No limit to amount of money tribunals can order govts to pay corps/investors

• Compound interest starting date if violation new norm ( compound interest ordered by tribunal doubles Occidental v. Ecuador $1.7B award to $3B plus• Rulings not bound by precedent. No outside appeal. Annulment for limited errors.

In detail, the White House arguments were just as disingenuous. The text starts out by saying that arbitration is widely used and therefore the public should see it as safe and uncontroversial. Bollocks. Arbitration in the US is most often used in take-it-or-leave it contracts like brokerage and credit card agreements and cell phone contracts. And arbitration is hardly squeaky-clean even in the US; see the lawsuits and controversies faced by the National Arbitration Forum, for instance.

Moreover, the rebuttal attempts to depict these corporate star chambers as consistent with constitutional Fifth Amendment protections:

But when government takes its citizen’s property from them – be it a person’s home or their business – the government is required to provide compensation. This is a core principle reflected in the U.S. Constitution and recognized under international law and the legal systems of many countries.

So since this premise is so well accepted (and Warren reminds us that the TPP signatories all have grown-up legal systems), pray tell why do we need a special system of de facto above the legal system panels for the biggest, richest companies who are in a better position than just about anyone to press for their legal rights? The idea that a special legal venue that is for well-heeled multinationals has anything to do with the rights of ordinary citizens is an insult to the reader’s intelligence.

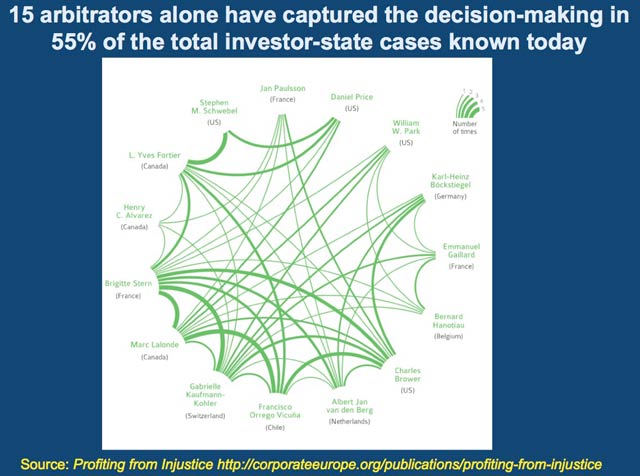

It’s ludicrous to compare run-of-the-mill US arbitration panels to ISDS forums. For example, in the US, arbitration clauses can be circumvented for reasons including failure of contract formation, unconscionability, and public policy. There’s no way out of ISDS. And recall Warren’s mention of conflicts of interest? It’s even worse than she intimated. Public Citizen examined how go between working for the companies and serving on the panels. A small and tight-knit group has disproportionate influence:

Consider the implications of the fact that the 15, and the larger community of panel “regulars,” work both sides of the street. They draw cases that go before the trade panel, as well as hear them. Thus it’s in their interest to issue aggressive rulings in order to facilitate more cases being filed. Yet the White House has the temerity to describe repeatedly ISDS as “neutral arbitration”!

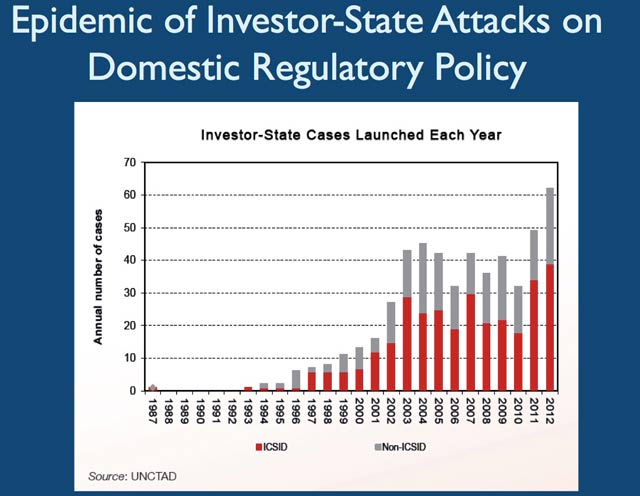

Voters are also supposed to take comfort from the fact that only 50 ISDS cases have been filed against the US and the US has won them all. That figure is meaningless without knowing the total filed, and irrelevant given, as Public Citizen stresses, investor rights are believed to be greatly strengthened in the TPP and TTIP, thus greatly increasing the role of these panels. Look at how this self-reinforcing system has been producing more case even before its gets its hoped-for turbo-charging through the pending trade deals:

And these cases are typically high stakes for the targeted country. Naked Capitalism readers have often referred to the Philip Morris suit against Australia for its requirement of plain packaging for cigarettes with prominent health warnings. The Administration statement also tries hair-splitting over another case that galvanized opinion in Germany against these trade forums, also described briefly in Elizabeth Warren’s Washington Post article, that of Swedish power company Vattenfal suing the German government over lost potential future profits due to the phase-out of nuclear power in Germany. Vattenfal is a serial trade pact litigant against Germany. In 2011, it sued for expected €1 billion plus losses in the case mentioned by Warren. In 2009, Vattenfall sued the German federal government over stricter environmental regulations on its coal-fired power plant in Hamburg-Moorburg, seeking €1.4 billion plus interest in damages. The parties settled out of court in August 2010.

So how did the Administration try to brush that off? By saying basically that the case didn’t require Germany to change the law, just to pay investors “for abrogating existing commitments”. Since when do companies have a right to a stable business environment? Written law, case law, the competitive environment, consumer appetites, and input prices change all the time. The Administration is, with a straight face, trying to defend the notion that running a business should be made free of risk. And it brushes aside the point we raised earlier, that vitiating enforcement is tantamount to vitiating regulation.

The Administration also tries to minimize the area where the regulatory race to the bottom created by the pending trade deals is almost certain to work against the US: in the financial regulatory realm. As weak as US reforms have been, the US is nevertheless generally seen as having done more to re-regulate than European countries. Moreover, even to the extent UK and European regulators have strengthened their rules, they’ve taken approaches that differ somewhat from those of the US, such as using contingent capital (aka “bail ins”) while we have had stronger requirements for higher capital levels.

Now the White House missive does point out that “prudential measures” for financial firms are exempted from the ISDS process. But that notion is vague and untested. And some areas where the US has been very aggressive in taking action against foreign firms, such as money laundering, are clearly not about the safety of the financial system.

And finally, for the Administration to insinuate that the TPP will result in greater transparency is dubious, given that it’s made it well-nigh impossible for anyone in Congress to do a proper review of the text. While the US Trade Representative technically allows access, in practice, that right is empty. The Congressman himself must read the text; no sending staffers or bringing experts allowed, and only staffers from the committees with direct oversight of trade bills (the Senate Finance Committee and the House Ways and Means Committee) are allowed to join their bosses. The USTR insists that the Congressman specify what chapter he wants to review in advance. The USTR then insists that the negotiator of those chapters be present. Since those negotiators travel, it usually takes three or four weeks to find a convenient time.

No note-taking is allowed. The text is full of bracketed sections where if language is disputed, the revisions suggested by other countries are in the brackets, with the country initials listed but then redacted, making it difficult to read (as in you can’t even read this dense text straight through; the flow of the document is interrupted by the various suggested changes). Having people from the USTR staring over your shoulder is distracting. And it’s an open question as to whether asking them questions is prudent, since it gives the USTR insight into what the Congressman is concerned about.

Perhaps these Congressmen have exceptional powers of concentration. But I read cases and legally dense material with some regularity, and I find my concentration starts going after an hour to an hour and a half. And I also find it is well nigh impossible to get much more than a general sense of a contract of any length in one pass. You need to go over it again and again to see how the various sections tie together to even have an approximate grasp of what it means. There’s simply no way that any Congressman has anything more than a very fuzzy idea of what is in the TPP and the TTIP.

They very fact that the Administration is going to such absurd lengths to prevent informed Congressional review should be sufficient reason in and of itself to turn down the Administration’s request for fast-track authority.

Call your Senators and Representative (find phone numbers here and here) and tell them to vote against fast track authority. If they are Democrats, stress that Elizabeth Warren is right, that the investor panels are a danger to America’s legal protections, and the Administration’s rebuttal is contradictory and belied by information already in the public domain. If they are Republicans, refer to the Cato analysis, that this is an unjustified de facto subsidy to multinational corporations that are better able to watch out for themselves than any other type of business. Encourage friends and family members to do the same. And tweet and circulate this post to help get the word out.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. We have hours left to raise the $12,0000 still needed to ensure Truthout remains safe, strong, and free. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.