There are many excellent arguments against the Trans-Pacific Partnership (TPP), two of which — local zoning over-rides, and loss of national sovereignty — I’ll briefly review as stepping stones to the main topic of the post: Absolutist Capitalism, for which I make two claims:

1) The TPP implies a form of absolute rule, a tyranny as James Madison would have understood the term, and

2) The TPP enshrines capitalization as a principle of jurisprudence.

Zoning over-rides and loss of national sovereignty may seem controversial to the political class, but these two last points may seem controversial even to NC readers. However, I hope to show both points follow easily from the arguments with which we are already familiar. Both flow from the Investor-State Dispute Settlement (ISDS) mechanism, of which I will now give two examples.

TPP’s ISDS and Local Zoning

I’m starting with local zoning because I think it’s an issue where “strange bedfellows” on left and right can work together (and so letter writing campaigns and visits to Congressional offices can be organized accordingly). I think it will be very hard to find find a constituency for a foreign corporation determining local land use, and easy to find constituencies against it.

Ben Ross wrote in Naked Capitalism:

Homeowners’ power to influence development—what I call “suburban land tenure” in my book Dead End—is an entitlement that most people in the United States take for granted. But it is just the sort of local decision-making the TPP seeks to curb.

Trade treaties aim for decision-making that is stable, predictable, and rational. US land use regulation, on the other hand, bends to meet the often capricious desires of the neighbors. Local officials turn to hard-to-pin-down concepts like “compatibility” and “historic significance” to justify their responsiveness to constituents.

Whatever one thinks of this arrangement, its linguistic evasions are unlikely to satisfy panels of trade lawyers meeting thousands of miles away, under rules that don’t even guarantee the local government the right to speak.

Consider this hypothetical case, which is also utterly routine: A foreign landowner proposes a new city building. Neighbors petition for a “historic” designation for the house now standing on the property, and the preservation board approves, blocking new construction. Meanwhile, there are no petitions or designations for nearby houses similar in age and architecture. Is the landowner entitled to compensation?

Or let’s say the master plan for an area near a Maryland Metro station calls for 15-story buildings. The zoning allows such tall buildings only if the planning board approves the design; otherwise property owners are limited to three stories. A foreign landowner applies to build a 15-floor building, but neighbors protest against the height of the structures and the planning board cuts the size to nine floors. Will the landowner get the value of the square feet he wasn’t allowed to build?

The landlord might the “compensation” for blocked construction, or “get the value” of the square feet, because an ISDS court would award them for “lost profits” (of which more in a moment).

TPP’s ISDS and State Sovereignty

Even though sovereignty, as an issue, seems absurdly large put beside zoning, I choose it because it too is an issue where the grassroots on left and right can unite. After all, whether you are a big government liberal who admires FDR, or a small government conservative who admires Coolidge, you don’t want the government of your country to be under the sway of an unelected, trans-national entity like Agenda 21 New World Order the ISDS putative courts.[1] Again from Naked Capitalism, here’s a description of ISDS:

[T]he investment chapter for the TPP was leaked, and the excellent Public Citizen[2] published it (link to the PDF). Their summary in relevant part describes the investor-state dispute settlement (ISDS) provisions:

These provisions are so extreme that many people unfamiliar with them tend to dismiss description of them or their implications…

Procedural rights that are not available to domestic investors to sue governments outside of national court systems, unconstrained by the rights and obligations of countries’ constitutions, laws and domestic court procedures (Section B). There is simply no reason for foreign investors to pursue claims against a nation outside of that nation’s judicial system, unless it is in an attempt to obtain greater rights than those provided under national law. Moreover, many of the TPP partners have strong domestic legal systems . For example, TPP partners New Zealand, Australia and Singapore are all ranked by the World Bank as performing at least as well as the United States with regard to control of corruption and adherence to rule of law. Yet in a manner that would enrage right and left alike, the private “investor-state” enforcement system included in the leaked TPP text would empower foreign investors and corporations to skirt domestic courts and laws and sue governments in foreign tribunals. There, they can demand cash compensation from domestic treasuries over domestic policies that they claim undermine their new investor rights and expected future profits. This establishes an alarming two-track system of justice that privileges foreign corporations in myriad ways relative to governments or domestic businesses. It also exposes signatory countries to vast liabilities, as foreign firms use foreign tribunals to raid public treasuries.

(Check the post for the actual text of the Invetment Chapter, as opposed to this summary.) Closer to (my) home, suppose a locality manages to block the East-West Corridor with a zoning regulation, or some farmers band together to block it under laws that protect wetlands, or the Penobscot Nation manages to block it from crossing the river on fishing rights grounds. And suppose Irving, the massive but privately held Canadian Energy firm that would almost certainly be an investor in the Corridor, sues any one of those small entities, or the State, under ISDS for “lost profits”? Even if we could afford to, how could we ever get a day in court? It’s hard enough to get standing, even in a country where we have the vote. Under ISDS, we’d have neither standing nor vote. Citizens of the United States would have acted entirely under the law of our own sovereign state, and the United States could end up on the hook for a billion or two, to a foreign corporation, Irving.[1] Irving could even demand to be paid in Canadian dollars!

Toward Absolutist Capitalism

Let’s look more deeply into the ISDS as an institution. First, we’ll look at the “Absolutist” nature of the TPP. Then we’ll look at “Capitalism” under the TPP.

The TPP Implies a Form of Absolute Rule, a Tyranny as James Madison Would Have Understood the Term. First, the ISDS tribunals, putatively courts, are completely unaccountable. Public Citizen:

TPP ISDS tribunals would be staffed by highly paid corporate lawyers unaccountable to any electorate or system of legal precedent.

Second, the ISDS tribunals are riddled with conflicts of interest and open invitations to corruption. Public Citizen:

Many of [the corporate lawyers] involved rotate between acting as “judges” and as advocates for the investors launching cases against governments. Such dual roles would be deemed unethical in most legal systems. The leaked text does not include new conflict of interest rules, despite growing concern about the bias inherent in the ISDS system.

Third, there is no appeal from the judgements of these putative courts. Public Citizen:

There is no internal or external mechanism to appeal the tribunal members’ decisions on the merits, and claims of procedural errors would be decided by another tribunal of corporate lawyers.

Fourth and finally, the discretion of the ISDS tribunals is so great that they can write the rules, as well as interpret them. Public Citizen:

There are no new safeguards that limit ISDS tribunals’ discretion to of governments’ obligations to foreign investors and order compensation on that basis.The leaked text reveals the same “safeguard” terms that have been included in U.S. pacts since the 2005 Central America Free Trade Agreement (CAFTA). CAFTA tribunals have simply ignored the “safeguard” provisions that the leaked text replicates for the TPP, and have continued to rule against governments based on to which governments never agreed.

In the first three points, the ISDS tribunals are acting as putative courts, albeit conflicted, potentially corrupt, and anti-democratic and unaccountable courts. However, in the fourth point, the tribunals are, functionally, legislatures. Here is what Madison had to say about mixing judicial and legislative power. Federalist 47:

The accumulation of all powers, legislative, executive, and judiciary, in the same hands, whether of one, a few, or many, and whether hereditary, self-appointed, or elective, may justly be pronounced the very definition of tyranny. …Were the power of judging joined with the legislative, the life and liberty of the subject would be exposed to arbitrary control, for the judge would then be the legislator.

So, what Madison warned of is exactly what ISDS does: The judge is the legislator, leading to “arbitary control.” And arbritary control is absolutism, just as surely as it was in the age of the divine right of kings. [2] And for bonus points, the judges and the legislators are conflicted, open to corruption, and accountable neither to the voters nor to any system of precedent.[3]

The TPP Enshrines Capitalization as a Principle of Jurisprudence . At this point one may ask, what do we mean by “Capitalism”? Answers differ (!), but for the purposes of this post, I’ll use the definition from Capital as Power (hat tip alert reader Sibiriak), by Jonathan Nitzan and Shimshon Bichler, which I’m reading with great interest. Page 153 and following:

The comprehensive reach, complexity and uniformity of the price system have made capitalism the most ordered society ever. … Now, price is merely the unit with which capitalism is ordered. The actual pattern of order – namely, the way in which prices are structured and restructured relative to one another – is governed by capitalization. Capitalization is the algorithm that generates and organizes prices. What exactly is capitalization? We have mentioned the term several times in the book, and it is now time to examine it more closely. Most generally, capitalization represents the present value of a future stream of earnings: it tells us how much a capitalist would be prepared to pay now to receive a flow of money later.

By the 1950s, capitalization was finally established as the heart of the capitalist nomos, engraved on both sides of the balance sheet. On the asset side, net present value became the practice of choice in capital budgeting to allocate corporate resources. Meanwhile, on the liabilities side, the invention of portfolio selection theory by Harry Markowitz (1952) and of the capital asset pricing model (CAPM) by William Sharpe (1964) and John Lintner (1965) bureaucratized the concept of risk and in so doing helped formalize the calculus of financial investment….

And, so, finally the floodgates were open. Nowadays, every expected income stream is a fair candidate for capitalization. And since income streams are generated by social entities, processes, organizations and institutions, we end up with the ‘capitalization of every thing’. Capitalists routinely discount human life, including its genetic code and social habits; they discount organized institutions from education and entertainment to religion and the law; they discount voluntary social networks; they discount urban violence, civil war and international conflict; they even discount the environmental future of humanity. Nothing seems to escape the piercing eye of capitalization: if it generates earning expectations it must have a price, and the algorithm that gives future earnings a price is capitalization.

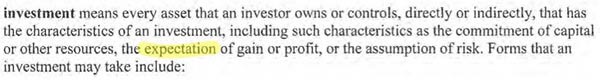

Of course, government — at least hitherto — has re-ordered prices, income steams, claims on future income streams, and capitalization generally since forever; one might even say that’s the purpose of government, its raison d’etre, at least in a capitalist society.[4] However, TPP’s jurisprudential innovation is to reframe such re-ordering as “expropriation,” and to set up the ISDS to compensate the capitalists for it. Naked Capitalism again, with images of the text of TPP’s “Investor Clause”:

Note that the expectation of profit is one of the characteristics of an investment. And what better judge of those expectations could there be than the investor?

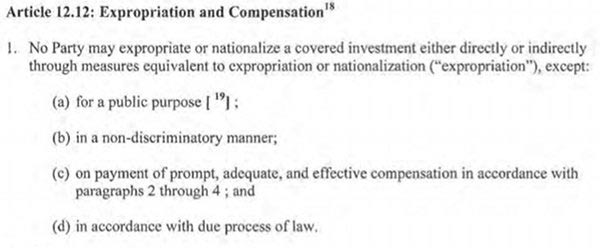

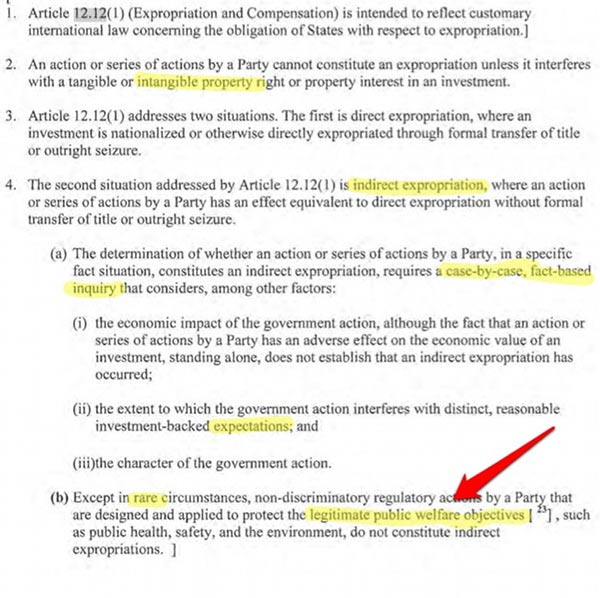

Can “expropriation” include state actions that damage an investors expectation of profit? You betcha! Here’s how that “direct ” wording gets teased out:

Get a load of those loopholes! “Intangible property rights” and “indirect expropriation” are to be determined on a “case-by-case, fact-based inquiry” as to whether “distinct” (sez who) and “reasonable” (sez who) “expectations” (sea who) were “interfered with.” But don’t worry, little governments! Only in “rare circumstances” will your “legitimate” (sez who) “public welfare objectives” be considered expropriations.

So, if you were a corporate lawyer, sitting in judgement on a TPP tribunal, totting up the damages some hapless government had wreaked against a corporation by, oh, providing its citizens with single payer health care or preventing an oil company from poisoning their groundwater through “excessive regulation” — or halting development to protect a historic site under local zoning ordinances, or halting the East-West Corridor to protect the Penobscot — what would you consider “distinct, reasonable, investment-backed expectations”? I’d guess it would be the Net Present Value (capitalization) calculations done by the wounded corporation itself, eh? Like on an Excel spreadsheet. What could be more credible? Or more just?

In other words, TPP elevates capitalization — the expectation of profit — as a principle to the level of, say, the Bill of Rights, or the Declaration of the Rights of Man. And then, government, when it provides concrete material benefits to its citizens, must “compensate” capitalists whenever their calculated, immaterial expectations — capitalization — have been “expropriated.” What a racket! TPP is the biggest enclosure in the history of the world!

Conclusion

“Arbitrary control” — absolutism — in service of capital as a global change in the constitutional order, and all done in secret. What could go wrong?

Notes

This isn’t a partisan issue. Conservatives who believe in U.S. sovereignty should be outraged that ISDS would shift power from American courts, whose authority is derived from our Constitution, to unaccountable international tribunals. Libertarians should be offended that ISDS effectively would offer a free taxpayer subsidy to countries with weak legal systems. And progressives should oppose ISDS because it would allow big multinationals to weaken labor and environmental rules.

2. To be fair, neither ISDS nor TPP has formal executive power; it joins only the legislative to the judicial power; ISDS decisions would have to be executed by the member states, or (and why not?) the corporations themselves.

3. Madison indeed argues that the judiciary is the weakest of the three branches of government. Federalist 78:

Whoever attentively considers the different departments of power must perceive, that, in a government in which they are separated from each other, the judiciary, from the nature of its functions, will always be the least dangerous to the political rights of the Constitution; because it will be least in a capacity to annoy or injure them. … It may truly be said to have neither FORCE nor WILL, but merely judgment; and must ultimately depend upon the aid of the executive arm even for the efficacy of its judgments.

However, I’m not sure that Madison had in mind a putative judiciary made up of lawyers representing powerful corporate interests, powerful enough to have their own powers of the purse, and even of the sword.

4. Here’s a fun example: Could Pearson, the test publisher, sue the School Districts in New York where parents recently opted-out of legally required high-stakes testing, if they lost any profits, or expected profits? How about the state of New York?

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. We have hours left to raise the $12,0000 still needed to ensure Truthout remains safe, strong, and free. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.