The era of historic renter militancy has just begun in this country. Thousands rallied in mid-September 2016 in 52 cities in 19 states for a Renters’ State of Emergency, chiefly concerning rent gouging and unjust evictions, largely due to monumental shortages of affordable housing. They’ve taken to the streets, city hall chambers and courts. They’ve picketed slumlords and got tough with rapacious landlords profiting from housing demand exceeding supply.

Moreover, protesters are getting organized locally and nationally through organizations like Homes for All, Tenants Together and Chicago’s Autonomous Tenants Union. Renter ranks have grown to 111,118,927, increased by the 7,300,000 homeowners who lost their homes from the 2008-era economic crash.

For dispossessed homeowners, ruined credit was bad enough, but they also faced a seven-year ban on rebuying, and lost the traditional social status favoring property owners over renters.

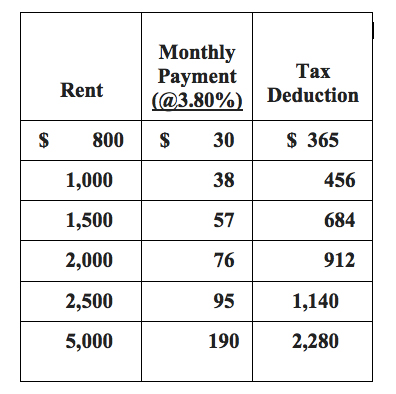

Perhaps the most infuriating blow was losing their mortgage-interest deduction from income taxes. It was not chump change. The average refund in 2015 was $3,218. Those paying $2,000, say, in monthly rent, might be interested to know what their 3.80 percent deduction rate would have fetched in refund checks if the Internal Revenue Service (IRS) permitted applying that deduction to rents. (The most galling aspect is knowing — as from antiquity — that part of rent pays the landlords’ mortgage interest.)

(Credit: Barbara Ellis)Renters’ Tax Deduction Shown at 3.80 Percent

(Credit: Barbara Ellis)Renters’ Tax Deduction Shown at 3.80 Percent

The table below shows what the mortgage-interest deduction would be if the current fixed 15-year/30-year/FHA 30-year mortgages were applied to rent.

If five millennials rented a house or apartment on that basis, the person writing the collective monthly check to the landlord would just apportion a five-way split on the tax refund — pro-rated by when each moved in. The landlord wouldn’t care as long as the IRS permitted this “double” deduction.

In a straw poll at my complex’s annual Christmas party and two popular Portland coffeehouses, the idea of a rent deduction/refund, needless to say, was wildly popular. One curmudgeonly retiree pointed out, however, that a mortgage was “goods” a landlord had purchased on a long-time basis from a financial institution. We renters merely used that good.

That was a sticking point until I remembered that credit card interest used to be a deductible whether covering goods such as cars, refrigerators, jewelry or services such as oil changes, restaurant meals, computer assistance, rental cars and the like.

But what is rent but a purchase of both goods and services, albeit for housing? It was certainly akin to charging long-term stays at hotels/motels. Now, some may not consider housing a human right, but it unquestionably has far greater necessity to our lives than a computer or playground set.

To the IRS then, interest was interest whether mortgage or credit card.

Congress Axes Credit-Card Interest Deduction in 1986

Alas, Congress axed credit-card interest as a deductible in the Tax Reform Act of 1986 seemingly because of US Treasury Department complaints about credit card interest refunds cutting the nation’s revenues. TurboTax explains the Treasury’s questionable reasoning in this way: “The personal [credit card] interest deduction was seen as encouraging Americans to spend money rather than save it; in reality, it also reduced tax revenues [because of those refunds]. That’s because money that people put in savings earned interest, which was taxable income, but if they ran up credit card debt, they could deduct the interest from their income, which lowered their tax liability.”

Ironically, the Treasury surely replenished those depleted revenues with incoming sales taxes. That’s because refunds almost always are instantly spent — boosting the economy. They’re used to pay down debts. Or buying big-ticket items consumers have wanted all year. Thus, merchants profit and regularly send back the taxed portion to Treasury.

As for banks demanding we save rather than spend, when the refund is deposited so we can write checks, isn’t the money listed — even temporarily — as part of bank reserves required by federal law? Too, we might deposit some of that refund in passbook savings if banks ever started offering a far more attractive interest rate on passbook savings than the current 0.06 percent.

Precedent Exists for Tenants’ Tax Deduction/Refunds

The important fact here is that precedent existed for years on credit-card interest deductions. Why not for rent, particularly because housing is a survival essential? It’s ethically and morally unfair, besides. Most of all, this policy denial also robs the nation’s stumbling economy that needs those 111,118,927 renters spending refund checks, boosting sales profits and returning astounding tax revenues to the Treasury Department.

Ironically, landlords might not seem so cruel and greedy because rent increases would increase refund sums.

Among other landlord advantages from a renters’ relief law would be tenants having a major incentive to pay rent fully and on time. Refunds would foster greater retention of responsible tenants, curtailing the need and expense of cleanups from revolving-door occupancies. A refund also would be an inducement for the wealthy to sign long-term leases for high-end “apartment homes.”

For tenants — and the Treasury Department — a major advantage would rest on significantly increasing the supply of rental units so that today’s shortage will be alleviated — and rents would not be pegged on what the traffic will bear. The more rental units, the more renters, the more refunds and the more commercial taxes increasing Treasury’s revenues.

Side Benefits of Renter Refunds: More Apartments = More Profits, Revenues

A munificent side-benefit of a Renters Relief bill would be developers recognizing that the market for high-rise condominiums will peak, but the apartment needs of the 99 percent will go on forever. The construction bonanza is in the offing with affordable apartment high-rises because of land limits.

For example, the US population in 2015 was 321,370,000, but by 2020, it’s expected to be 334,500,000. If one calculates, say, 99 percent of those 334.5 million, apartment demands will be staggering. They’ll be filled with increased householders spending refunds, thereby improving the economy — and quickly refilling Treasury’s coffers with merchants’ taxable profits.

Additionally, all that construction means thousands of jobs (with taxable income on each worker) and taxable profits from producers and sellers of equipment and materials.

Congress recently has warmed up to renters’ struggles, something they relate to intimately because most members are renters in prohibitively expensive Washington, D.C. — especially in the House, with its two-year term limits. At least 50 members — including House Speaker Paul Ryan and majority leader Kevin McCarthy — sleep in their offices to avoid paying rent.

The trial balloon for a Renters’ Relief bill was lofted in February 2016 by Florida Democrat Rep. Alan Grayson hoppering the Renters’ Fairness and Equality Act. It asked for all rent to be deductible, which may explain why it had no sponsors and died in committee. But Grayson at least has thrust open the door in the upcoming session for a new bill with a far smaller portion of rent to be tax deductible. That might gain sponsors by all renters in both houses.

With new Senators and House members arriving in Washington and personally confronted with this decades-old, blatant tax inequity to renters, it’s a superb opportunity for a new bipartisan bill to be filed that’s a “win-winner” for 111,118,927 potential voters in the 2018 mid-term elections.

As renters, our role in passage must be a full-court press: Online petitions, emails, phone calls, visits to local or Congressional offices, and for demonstration activists to incorporate tax deductions in their demands. University of Arizona sociology professor Jennifer Earl says that: “The real key for grassroots social change is to engage as many people as possible.”

Indeed, that’s what’s happening to one of Europe’s largest banks (Nordea) for backing the Dakota Access pipeline in North Dakota. Outraged customers are demanding it stop the company’s financing. A Nordea investment official revealed the successful payoff for electronic lobbying: “My bank has received hundreds of emails and Facebook messages. It’s like a storm that is pushing the bank in a direction that the bank then needs to act on.” Other lenders reportedly are having the same second thoughts about other pipelines because this year’s divestments alone involve $5,000,000,000,000.

If the nation’s 111,118,927 renters contact their receptive counterparts in Congress — perhaps by attaching a PDF of this article — we may finally get this long-overdue deduction. So, to the keyboard, fellow renters!