A napkin can be a dangerous thing in the hands of fools. Especially when the D students sit in the Oval Office.

President Donald Trump’s mind-blowing $2 trillion tax cut, according to his Treasury Secretary Steve Mnuchin, “Will pay for itself with growth.”

The storied economist John Maynard Keynes once said, “Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back.”

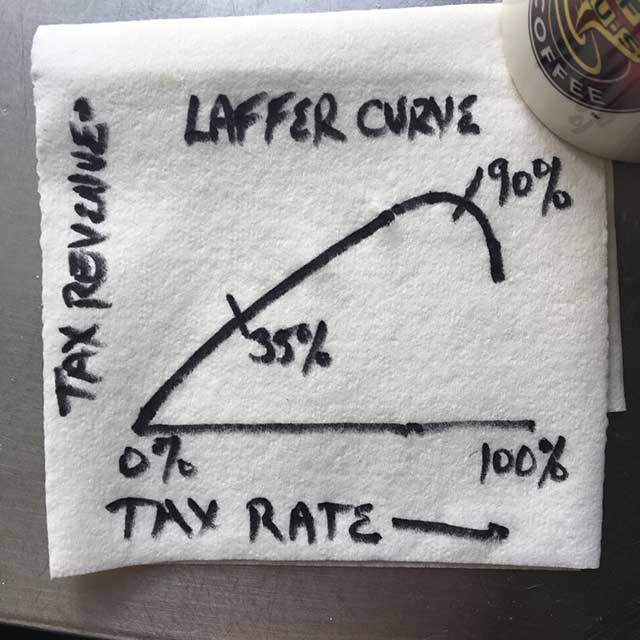

The scribbler, in this case, is my old professor and mentor, Art Laffer. Famously, he did his scribblings on napkins, a corollary of his addiction to greasy cheeseburgers.

In 1974, over burgers at the University of Chicago student grill, he scribbled a curve on a napkin, illustrating a curiosity: the higher the tax rate, the lower the total tax collection. Or, turned around: a cut in taxes can pay for itself.

(Credit: Greg Palast)

(Credit: Greg Palast)

But, alas, Art told me, this economic magic trick only works at the tippy-top of the curve, “Maybe just in Sweden where rates are 98 percent or even 102 percent.” But in the US, with 40 percent top rates? The magic is gone.

Unfortunately for the US, Art also showed his napkin trick to one Dick Cheney, very much not a professor of economics … and from there the “Laffer Curve” made its way to Ronald Reagan.

Our first actor-president, not savvy to the subtle calculus of the curve, wrote about this miracle no-cost tax cut while running in 1976, “Warren Harding did it. John F. Kennedy did it … cut the income tax. In both cases, federal income went up instead of down.”

The Gipper’s opponent, George H.W. Bush called it “voodoo economics.” Indeed, when Reagan implemented this “miracle,” it blew the doors off the national debt.

Laffer, today as in 1974, remains a conservative fan of shrinking government and tiny taxes. So, he and his colleague, Trump advisor Stephen Moore, still promote a “scientific” form of free-lunch tax cuts.

Scientific or not, our latest actor-president has swallowed napkin-omics whole.

The result will be anything but magical. Let’s get into the nasty details.

First, Trump would cut the AMT, the Alternative Minimum Tax, to the rate of absolute zero. It may be just a coincidence, but the AMT is the only income tax that Trump is known to have paid.

Did the AMT really stop Trump and other real estate moguls from investing? There’s no evidence the tax caused Trump to stuff his billions into a mattress. He boasts of his spending of $200 million to refurbish the Old Post Office in Washington. Moreover, $1.7 billion of his invested capital sits in high-tax New York. Paying the AMT clearly did not discourage investor Trump.

Even beyond the creepy conflict of Trump giving himself a tax cut, eliminating the AMT is truly bad policy. According to what my professors Laffer and Milton Friedman taught me, taxes should be designed to stop investors from making decisions based on how to avoid taxes. The AMT tells investors, “Forget avoiding taxes — you’ll pay them anyway.” Now, with Trump eliminating the AMT, it’s “Dive for the loopholes, gents.”

And loopholes there are, still worth billions. The big one, which candidate Trump vowed to close, is called “carried interest.” Candidate Trump promised, “We will eliminate the carried interest deduction and other special interest loopholes that have been so good for Wall Street investors, and for people like me, but unfair to American workers.”

But he didn’t. In fact, Trump went the opposite way, killing a 3.8 percent surtax on speculation profits that Obama instituted to cut health insurance rates under Obamacare.

A billionaire most burdened by the Obamacare tax, and a beneficiary of the carried interest loophole, is Paul Singer. Singer, aka “The Vulture,” was a secret visitor to the Oval Office in February — until Trump let the secret out of the bag. Shortly after that meeting, via the Trumpcare bill, Trump nixed the Obamacare surtax on Singer and his speculator colleagues.

But Trumpcare flatlined, so Trump simply put the elimination of the speculation tax into this new bill. Total cost to the Treasury: $15.7 billion.

And who will make up for the lost billions and trillions? The answer is: you, me and the guys in the funny red Make-America-Great hats.

Trump boasted that he’d be the first candidate ever to turn a profit on a presidential campaign. And now, it looks like the profits will be tax-free.

Surprised? When power meets greed, you can bet, the schmucks in the red hats will pay.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $33,000 in the next 2 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.