“The struggle between rich and poor has largely taken the form of conflicts between creditors and debtors.” — David Graeber

Zack’s Investment Research recently recommended that people buy stock for Navient (formerly Sallie Mae), the nation’s largest servicer of student loans. This may seem curious given that the company is facing a historic lawsuit filed on January 18 from the Consumer Financial Protection Bureau (CFPB), that alleges (in agreement with aggrieved student borrowers) that the company has “illegally cheated many struggling borrowers” for years through “shortcuts and deceptions.”

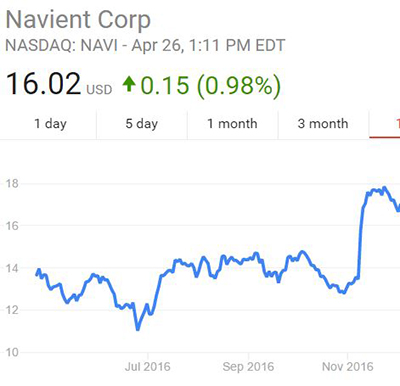

Organizers are cautiously optimistic the lawsuit may lead to relief and/or reform in the coming years. But this “heightened regulatory scrutiny over alleged anti-consumer practices” isn’t scaring investors, who remain bullish on student loan bullies. Navient’s shares outperformed expectations, benefiting from a 30 percent spike in its stock just as Donald Trump was elected president.

The 30 percent spike in Navient (Sallie Mae) stocks directly after the election of Donald Trump. (Source: Yahoo / MSM Finance)Good news for Navient tends to be bad news for those suffering from the ever-worsening student loan crisis, which was already perilous before Trump and his education secretary Betsy DeVos started shaping policy, to the delight of predatory student lenders. DeVos has already cut consumer protections, notably reversing an Obama executive order on April 17 that put, as the New York Times reported, “great weight on a company’s track record when selecting student loan vendors” to service federal loans. This means the very same government that is suing Navient for “cheating borrowers,” is now unable to consider this when handing out massive contracts.

The 30 percent spike in Navient (Sallie Mae) stocks directly after the election of Donald Trump. (Source: Yahoo / MSM Finance)Good news for Navient tends to be bad news for those suffering from the ever-worsening student loan crisis, which was already perilous before Trump and his education secretary Betsy DeVos started shaping policy, to the delight of predatory student lenders. DeVos has already cut consumer protections, notably reversing an Obama executive order on April 17 that put, as the New York Times reported, “great weight on a company’s track record when selecting student loan vendors” to service federal loans. This means the very same government that is suing Navient for “cheating borrowers,” is now unable to consider this when handing out massive contracts.

Essentially, Navient gets de facto amnesty for its past mistakes, a luxury its borrowers aren’t afforded. Three days after DeVos made this decision, Navient announced controversial plans to further consolidate its share of the market by purchasing $6.9 billion in loans from JP Morgan Chase, and another jump in stock prices followed.

The spike in stocks that correlates with Betsy Davos’s rollback of Obama-era protections for student loans. (Source: Yahoo / MSM Finance)

The spike in stocks that correlates with Betsy Davos’s rollback of Obama-era protections for student loans. (Source: Yahoo / MSM Finance)

“The worse job they do, the more money they make,” said Alan Collinge, executive director of Student Loan Justice (SLJ), in an interview with Truthout. “It is the epitome of bad-faith lending.”

Private lenders’ continued abuses are only part of the reason that the student loan crisis has been described as America’s “most pressing economic problem,” accounting for more than $1.4 trillion in debt with 40 percent or more in default. Corporate shareholders and the Department of Education (DOE) are both profiting off the misery of student borrowers, which has led to depression, substance abuse, family estrangement and even suicide. The president has made use of bankruptcy protection either four or six times, depending on who you speak with, but this is not an option for student borrowers.

Debt has long been an effective form of social control. The current debt crisis reflects systematic class warfare waged by the rich against the poor and working class.

“In our time, the financial sector has enriched itself,” writes labor expert Steve Fraser, “by saddling ordinary working people with every conceivable form of consumer debt.”

It is no coincidence, in this context, that student debt was a major issue in both Bernie Sanders’ presidential campaign and the Occupy movement. Chris Longenecker, a founding member of Occupy Wall Street, told Truthout that Occupy activists talked about student loans frequently and that “there were also student debt strike programs that got off the ground to varying levels of success.”

Both of these movements are factors in the nation becoming increasingly engaged and educated in class issues. With this class consciousness and energy, many organizers feel the fight for student loan justice can be central in the larger battle for justice and equality.

“I truly believe this issue can be one that unites people. We have seen a seismic shift in interest about this issue in recent years,” said Natalia Abrams, executive director of Student Debt Crisis, in an interview with Truthout.

Shared Complicity

The lack of bankruptcy protection is not merely the handiwork of the powerful private student loan industry, nor of Republican politicians. Bankruptcy protection existed for private student loans until 2005 when, with the help of then-Senator Joe Biden, this fundamental protection was taken away in the Bankruptcy Abuse Prevention and Consumer Protection Act. Subsequent legislation to restore these protections has stalled in Congress, even when Democrats controlled it, despite heartbreaking testimony at hearings.

“Bankruptcy protection was viewed as such an important right that our Founding Fathers addressed the need for a uniform system of bankruptcy in the Constitution [Article 1, Section 8, Clause 4], before even the power to declare war,” Collinge said.

The DOE never allowed bankruptcy protections for public loans, even before 2005 — yet another example of the shared complicity for the crisis among the private sector and the government. It is true that borrowers of private loans face unique challenges and are often ignored in reform efforts. But, as Collinge notes, Navient’s alleged crimes are hardly more contemptible than practices that are perfectly legal and used by the government against debtors. “Public loans are worse than private ones in many ways,” he said.

Those who default on federal loans, for instance, can be subject to all sorts of indignities and punishments, including the loss of professional licenses (and in some states, driver’s licenses). Nor are they even protected by a statute of limitations, something granted to most criminal acts besides murder or treason. (Borrowers of private loans, on the other hand, are afforded a statute of limitations.) The federal government will even garnish social security checks — of either the student or a co-signer — decades after a loan goes into default.

Borrowers of public loans, unlike those with private ones, have several beneficial federal programs at their disposal, but the government is refusing to honor some of them. Many students who enrolled in the Public Service Loan Program, a George W. Bush-era policy that offered debt forgiveness to graduates who worked in public service after 10 years of payments, are now being told by the government that it “changed its mind” about their eligibility years after the fact. Many students had radically altered the course of their lives to pursue debt forgiveness, choosing and sticking with jobs specifically to adhere to the program. They are now, with the help of the American Bar Association, filing suit.

Public loan recipients can benefit from an important Obama-era protection, the income-based repayment (IBR) plan, which allows federal loan borrowers to limit payments to 10 or 15 percent of their discretionary income. While hardly a solution to the crisis, the plan can help federal (but not private) borrowers significantly. “Nobody with federal loans should need to go into default as long as this program is in place,” Abrams said.

But many eligible Americans aren’t aware that the program exists. (A prominent allegation in the CFPB lawsuit accuses Navient of misleading people on this very issue.) Moreover, more than half of those in the program are kicked out for not keeping up with renewal notices and proof of income standards. “The programs are shamelessly constructed in a way that kicks people out of them,” Collinge said.

Many borrowers are also experiencing understandable fear that the GOP may try to cut these programs. “We tell people to sign up right away,” said Abrams. “We can’t make promises, but getting signed up now may well protect you from potential cuts or changes.”

Prospects for a terrible bipartisan compromise also loom. In his last year in office, Obama himself proposed adding a lifetime cap of $57,500 to those enrolled in these programs. Such a cap, Abrams notes, “defeats the whole purpose of the program.” It will be up to the public to pressure Democrats to not abandon student borrowers.

Debt Beyond Death: Not Just a Millennial Crisis

In some cases, not even death can be counted on to stop draconian debt collection. Consider the case of Marcia DeOliveira-Longinetti, initially reported by a ProPublica/New York Times joint investigation. Her son borrowed $18,000 from the Higher Education Student Assistance Authority (HESAA), public-private hybrid lender in New Jersey. He can’t make the payments because he was murdered years ago.

Not long after the murder, DeOliveira-Longinetti received a letter telling her she was still on the hook for his loan.

“My son borrowed $18,000. By the time I am done paying, it will have accrued to $40,000,” said DeOliveira-Longinetti in an interview with Truthout. “And he is long dead and never going to graduate.”

The grieving mother told the loan agency, whose ethics have come under question many times, that she would pay the principal, but even that offer was rejected. DeOliveira-Longinetti recognizes the egregious injustice of these tactics, which is why she went public. “Wall Street investors gaining from grieving parents? Benefiting from someone’s death? How unfair is that…. It is like the mafia,” she said.

Her courageous story prompted outrage among politicians and citizens alike, and the state’s policy was changed. However, the law was not retroactive, and didn’t impact DeOliveira-Longinetti’s obligation to pay, she said, noting that her goal in advocating for a policy change was “to avoid future suffering.”

“Nobody deserves what we are going through,” DeOliveira-Longinetti said. Her courage to tell her story helped her make significant progress, but she remains a victim of egregious and cruel policies toward students and co-signers alike.

Her story also challenges the myth that the student loan crisis is just a problem for young people.

“This issue is multigenerational. It impacts people of all ages,” Abrams said.

Parental co-signers — who commit the sin of helping their kids attend college — are often on the hook when their children can’t make payments. This dynamic doesn’t just ruin credit; it ruins families.

“The stories of families being broken up over co-signed loans, of students losing touch with their parents because [of] the pain their default caused the family, those are the most tragic stories I have heard, other than suicides,” Collinge said.

The Great Hypocrisy: Debt as a Moral Failing?

When facing financial peril, for-profit corporations have all sorts of options, including taxpayer-funded bailouts and strategic bankruptcy. But when this happens, notes Robert Kuttner in the New York Review of Books, “morality scarcely enters the conversation — this is strictly business.”

Humans who suffer this same fate, however, are treated as lazy “kids who don’t want to pay their loans back” or “get a job.” These smears are especially rampant against young people who are disproportionately suffering from (but did not cause) the macroeconomic conditions that led to the crisis: decades of wage stagnation, tuition increasing rapidly past the rate of inflation, the near collapse of the economy in 2008 and the subsequent Great Recession.

This sentiment reflects a common attack used by the wealthy against poor people of all ages: the claim that being poor, or in debt, is a result of personal and moral failings. Critics argue students made their own beds by taking loans. But, many college students start making decisions on where to attend school while still in high school and without proper financial literacy. They are also largely encouraged to attend the best college they’ve been accepted to, by teachers, counselors and a culture and news media that promotes higher education as an important milestone. Studies dating back to the start of the 21st century have shown that people in this country view college as a key to the American Dream. Why does our country then put students through such hell?

It is hard for 17-year-old college applicants to wrap their heads around the fact that, as one borrower named Angela notes on the Student Loan Justice website, a $97,000 loan might end up costing over $270,000 for 25 years, with monthly payments ballooning up to $1,450 a month. Given the way civic classes glorify the United States as the land of opportunity, it can be hard for young people to recognize how the decision to attend school can lead to such problems.

“I will absolutely not deny my ignorance in the beginning of my college career,” Angela wrote on the SLJ page devoted to borrowers sharing stories. “I was the first in my family to go to college, and I was very excited to be accepted at Seton Hall University. I took out the entire tuition with Sallie Mae because that was what I could get approved for and they made it sound so wonderful with low interest, and flexibility. Wow, I was in for a shock when I received the bill a week post-graduation.”

“I know many people who have just resigned themselves to the fact that they will die in debt,” Abrams said. “They simply cannot keep up with all the interest and fees. It is very sad.”

Lawsuits and Legislation: Is Help on the Way?

Despite all the bad news, the landmark CFPB lawsuit against Navient is an important, if overdue, measure. The decision to push the lawsuit through during the last hours of the Obama presidency was no accident; it put the matter before the judicial branch and, hopefully, out of the reach of Trump. The 66-page lawsuit gives an astounding and detailed list of abuses against borrowers. It claims, among other things, that Navient had made misleading statements to borrowers about how their credit would be impacted by various actions, about how to enroll in less expensive (and less profitable to Navient) programs and a lack of a systematic way to solve mistakes after getting complaints.

Even seeing these accusations put to paper validates the frustrations of countless borrowers who have felt stuck in an impossible situation, organizers said.

Still, Navient has denied everything, and the judicial process could take many years. Organizers hope it leads to restitution for borrowers, discipline for Navient, and/or reform of the student loan process — an optimistic set of goals, they readily admit.

In the interim, organizers emphasize the importance of fighting to protect the programs that exist, seek redress for those who have been left without options, protect the CFPB and support legislative efforts to change the system. Sanders recently introduced a bill which would make public colleges tuition free for 80 percent of the population. This is extremely important; rising tuition is a major factor behind the debt crisis. But, as Abrams notes, it is also important to consider current debtors, not merely future students.

In the past several legislators have proposed bills that would allow students to refinance their loans at lower interest rates. Some of these bills, notably Elizabeth Warren’s refinancing bill, died on the Senate floor, getting 56 of the 60 votes it needed. In addition to lowering interest rates for federal borrowers, the bill would’ve also addressed private borrowers, by having the government buy up private loans so they could benefit from the lower rates as well. This would also enable private loans to be eligible for other federal programs they have previously been unable to use, such as income-based repayment options.

There is some disagreement among organizers regarding the refinancing approach. While Warren’s bill was supported by most progressive organizations, Collinge was critical of the legislation, arguing that bankruptcy protection, for both federal and private loans, is far more pressing than refinancing. Warren’s bill, he said, “looked suspiciously like a bailout for private lenders, who would love to sell their crap private loans to the government for full book value, plus a premium.”

Debt Forgiveness: The Ultimate Solution

“Student loans are killing people,” proclaimed economist Anthony Orlando in a recent article about the need for debt forgiveness. “People need to understand just how big a problem we’re talking about.”

Some people laugh off debt forgiveness as a utopian fantasy, but it would actually have stimulative benefits and could be part of a broader set of economic and educational reforms. The lenders, depending on the details, would have some incentive since a debt-forgiveness program would likely involve the government buying up these bad loans.

Debt forgiveness is as old as credit itself. It is referenced in Shakespeare, the Bible and the Quran. More importantly, it has been used on a national scale in modern countries, such as Germany, where allies forgave 93 percent of Nazi-era debt soon after World War II. “Forgiving debt, if done right, can get an economy back on its feet,” observed an Associated Press article in 2015.

Furthermore, today’s young people, who are suffering the brunt of this crisis, largely “reject capitalism” and, according to an April 18 Harvard/Harris poll, have made a self-identified socialist into the “most popular” politician in the country.

Bold ideas like debt forgiveness and free tuition will be taken more seriously as today’s millennials become tomorrow’s leaders, so long as activists continue to organize and educate themselves about the injustices our economic system inflicts on our own people.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. We have hours left to raise the $12,0000 still needed to ensure Truthout remains safe, strong, and free. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.