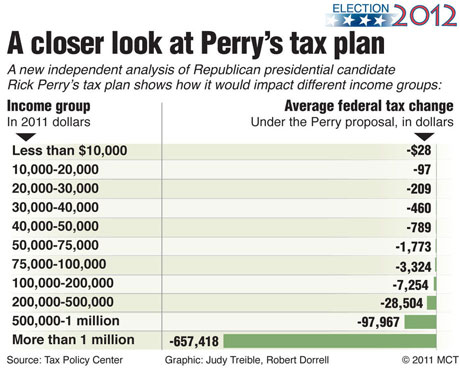

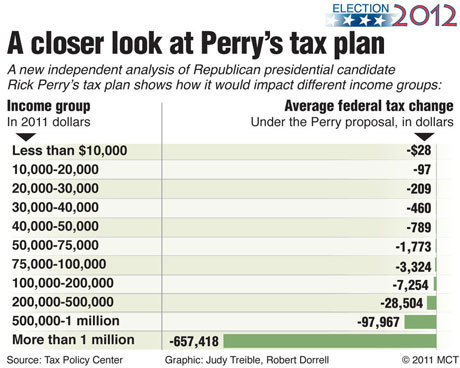

West Des Moines, Iowa – Rick Perry's proposed optional flat tax would be a windfall for wealthier Americans, giving millionaires an average tax cut of $637,418, according to an analysis by the nonpartisan Tax Policy Research Center released Monday.

While the tax cuts would be greatest at the top of the income scale, Perry's proposal would give all taxpayers at least some tax cut, according to the analysis. Those making less than $10,000, for example, would get an average tax cut of $28.

The largesse comes with a cost, however. The center estimates the Perry plan would mean $995 billion less for the federal government in 2015 — a shortfall that could well be added to the annual deficit and the federal debt.

<!— story_feature_box.comp —><!— /story_feature_box.comp —>

“The Perry plan would reduce federal tax revenues dramatically,” said the Tax Policy Research Center.

The analysis is the first independent look at the plan from the Texas governor, one of several flat tax and tax overhaul proposals being offered by candidates for the 2012 Republican presidential nomination.

Notably, Perry's plan would offer greater tax cuts to the wealthiest Americans than the “9-9-9” plan of rival Herman Cain. But Perry's blueprint also would give everyone a cut, while Cain's initial plan would raise taxes on everyone making less than $200,000.

The impact of Perry's overall proposal, according to the center:

- Those making less than $10,000 would get an average annual tax cut of $28;

- Between $10,000 and $20,000, an average tax cut of $97;

- Between $20,000 and $30,000, an average tax cut of $209;

- Between $30,000 and $40,000, an average tax cut of $460;

- Between $40,000 and $50,000, an average tax cut of $789;

- Between $50,000 and $75,000, an average tax cut of $1,773;

- Between $75,000 and $100,000, an average tax cut of $3,324;

- Between $100,000 and $200,000, an average tax cut of $7,254;

- Between $200,000 and $500,000, an average tax cut of $28,504

- Between $500,000 and $1 million, an average tax cut of $97,967;

- More than $1 million, an average tax cut of $637,418.

Perry proposes two systems.

In one, anyone would have the right to use the current tax system, which presumably guards against Cain-like tax increases.

In the second, Perry would allow people to pay 20 percent of all their income AFTER they deduct $12,500 per person, charitable contributions and state and local taxes.

He'd phase out the deductions for incomes above $500,000. But he'd also add in other tax cuts for wealthier households by eliminating taxes on long-term capital gains and some dividends, and repealing the federal estate tax levied on the richest families in the country.

Based on data supplied by Perry's campaign and its own analysis by John Dunham Associates, the Tax Policy Research Center concluded that Perry's plan would let the Bush tax cuts expire as scheduled at the end of 2012, in favor of the new system.

On the Web:

The Tax Policy Center's analysis of Texas Gov. Rick Perry's tax plan

© 2011 McClatchy-Tribune Information Services

Truthout has licensed this content. It may not be reproduced by any other source and is not covered by our Creative Commons license.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $27,000 in the next 24 hours. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.