America’s broken health-care system suffers from what appear to be two separate problems. From the right, a chorus warns of the dangers of rising costs; we on the left focus on the growing number of people going without health care because they lack adequate insurance. This division of labor allows the right to dismiss attempts to extend coverage while crying crocodile tears for the 40 million uninsured. But the division between problem of cost and the problem of coverage is misguided. It is founded on the assumption, common among neoclassical economists, that the current market system is efficient. Instead, however, the current system is inherently inefficient; it is the very source of the rising cost pressures. In fact, the only way we can control health-care costs and avoid fiscal and economic catastrophe is to establish a single-payer system with universal coverage.

The rising cost of health care threatens the U.S. economy. For decades, the cost of health insurance has been rising at over twice the general rate of inflation; the share of American income going to pay for health care has more than doubled since 1970 from 7% to 17%. By driving up costs for employees, retirees, the needy, the young, and the old, rising health-care costs have become a major problem for governments at every level. Health costs are squeezing public spending needed for education and infrastructure. Rising costs threaten all Americans by squeezing the income available for other activities. Indeed, if current trends continued, the entire economy would be absorbed by health care by the 2050s.

Conservatives argue that providing universal coverage would bring this fiscal Armageddon on even sooner by increasing the number of people receiving care. Following this logic, their policy has been to restrict access to health care by raising insurance deductibles, copayments, and cost sharing and by reducing access to insurance. Even before the Great Recession, growing numbers of American adults were uninsured or underinsured. Between 2003 and 2007, the share of non-elderly adults without adequate health insurance rose from 35% to 42%, reaching 75 million. This number has grown substantially since then, with the recession reducing employment and with the continued decline in employer-provided health insurance. Content to believe that our current health-care system is efficient, conservatives assume that costs would have risen more had these millions not lost access, and likewise believe that extending health-insurance coverage to tens of millions using a plan like the Affordable Care Act would drive up costs even further. Attacks on employee health insurance and on Medicare and Medicaid come from this same logic—the idea that the only way to control health-care costs is to reduce the number of people with access to health care. If we do not find a way to control costs by increasing access, there will be more proposals like that of Rep. Paul Ryan (R-Wisc.) and the Republicans in the House of Representatives to slash Medicaid and abolish Medicare.

The Problem of Cost in a Private, For-Profit Health Insurance System

If health insurance were like other commodities, like shoes or bow ties, then reducing access might lower costs by reducing demands on suppliers for time and materials. But health care is different because so much of the cost of providing it is in the administration of the payment system rather than in the actual work of doctors, nurses, and other providers, and because coordination and cooperation among different providers is essential for effective and efficient health care. It is not cost pressures on providers that are driving up health-care costs; instead, costs are rising because of what economists call transaction costs, the rising cost of administering and coordinating a system that is designed to reduce access.

The health-insurance and health-care markets are different from most other markets because private companies selling insurance do not want to sell to everyone, but only to those unlikely to need care (and, therefore, most likely to drop coverage if prices rise). As much as 70% of the “losses” suffered by health-insurance providers—that is, the money they pay out in claims—goes to as few as 10% of their subscribers. This creates a powerful incentive for companies to screen subscribers, to identify those likely to submit claims, and to harass them so that they will drop their coverage and go elsewhere. The collection of insurance-related information has become a major source of waste in the American economy because it is not organized to improve patient care but to harass and to drive away needy subscribers and their health-care providers. Because driving away the sick is so profitable for health insurers, they are doing it more and more, creating the enormous bureaucratic waste that characterizes the process of billing and insurance handling. Rising by over 10% a year for the past 25 years, health insurers’ administrative costs are among the fastest-growing in the U.S. health-care sector. Doctors in private practice now spend as much as 25% of their revenue on administration, nearly $70,000 per physician for billing and insurance costs.

For-profit health insurance also creates waste by discouraging people from receiving preventive care and by driving the sick into more expensive care settings. Almost a third of Americans with “adequate” health insurance go without care every year due to costs, and the proportion going without care rises to over half of those with “inadequate” insurance and over two-thirds for those without insurance. Nearly half of the uninsured have no regular source of care, and a third did not fill a prescription in the past year because of cost. All of this unutilized care might appear to save the system money. But it doesn’t. Reducing access does not reduce health-care expenditures when it makes people sicker and pushes them into hospitals and emergency rooms, which are the most expensive settings for health care and are often the least efficient because care provided in these settings rarely has continuity or follow-up.

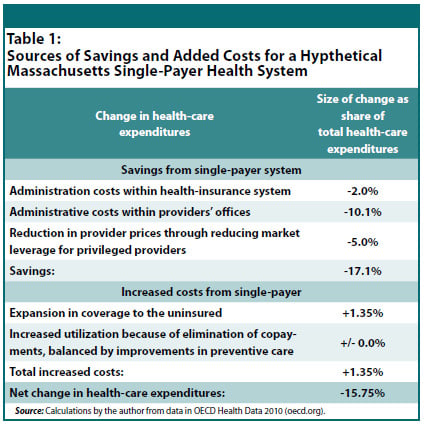

Table 1: Sources of Savings and Added Costs for a Hypothetical Massachusetts Single-Payer Health System

The great waste in our current private insurance system is an opportunity for policy because it makes it possible to economize on spending by replacing our current system with one providing universal access. I have estimated that in Massachusetts, a state with a relatively efficient health-insurance system, it would be possible to lower the cost of providing health care by nearly 16% even after providing coverage to everyone in the state currently without insurance (see Table 1). This could be done largely by reducing the cost of administering the private insurance system, with most of the savings coming within providers’ offices by reducing the costs of billing and processing insurance claims. This is a conservative estimate made for a state with a relatively efficient health-insurance system. In a report prepared for the state of Vermont, William Hsiao of the Harvard School of Public Health and MIT economist Jonathan Gruber estimate that shifting to a single-payer system could lead to savings of around 25% through reduced administrative cost and improved delivery of care. (They have also noted that administrative savings would be even larger if the entire country shifted to a single-payer system because this would save the cost of billing people with private, out-of-state insurance plans.) In Massachusetts, my conservative estimates suggests that as much as $10 billion a year could be saved by shifting to a single-payer system.

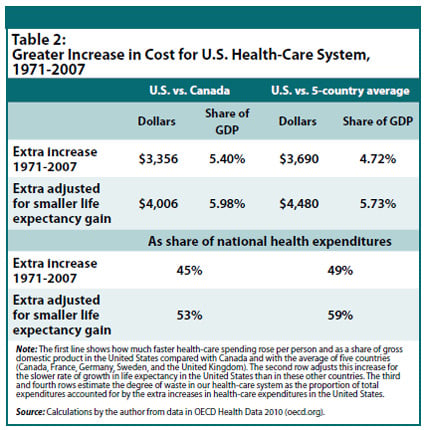

Table 2: Greater Increase in Cost for U.S. Health-Care System, 1971-2007

Single-Payer Systems Control Costs by Providing Better Care

Adoption of a single-payer health-insurance program with universal coverage could also save money and improve care by allowing better coordination of care among different providers and by providing a continuity of care that is not possible with competing insurance plans. A comparison of health care in the United States with health care in other countries shows how large these cost savings might be. When Canada first adopted its current health-care financing system in 1968, the health-care share of the national gross domestic product in the United States (7.1%) was nearly the same as in Canada (6.9%), and only a little higher than in other advanced economies. Since then, however, health care has become dramatically more expensive in the United States. In the United States, per capita health-care spending since 1971 has risen by over $6,900 compared with an increase of less than $3,600 in Canada and barely $3,200 elsewhere (see Table 2). Physician Steffie Woolhandler and others have shown how much of this discrepancy between the experience of the United States and Canada can be associated with the lower administrative costs of Canada’s single-payer system; she has found that administrative costs are nearly twice as high in the United States as in Canada—31% of costs versus 17%.

The United States is unique among advanced economies both for its reliance on private health insurance and for rapid inflation in health-care costs. Health-care costs have risen faster in the United States than in any other advanced economy: twice as fast as in Canada, France, Germany, Sweden, or the United Kingdom. We might accept higher and rapidly rising costs had Americans experienced better health outcomes. But using life expectancy at birth as a measure of general health, we have gone from a relatively healthy country to a relatively unhealthy one. Our gain in life expectancy since 1971 (5.4 years for women) is impressive except when put beside other advanced economies (where the average increase is 7.3 years).

The relatively slow increase in life expectancy in the United States highlights the gross inefficiency of our private health-care system. Had the United States increased life expectancy at the same dollar cost as in other countries, we would have saved nearly $4,500 per person. Or, put another way, had we increased life expectancy at the same rate as other countries, our spending increase since 1971 would have bought an extra 15 years of life expectancy, 10 years more than we have. The failure of American life expectancy to rise as fast as life expectancy elsewhere can be directly tied to the inequitable provision of health care through our private, for-profit health-insurance system. Increases in life expectancy since 1990 have been largely restricted to relatively affluent Americans with better health insurance. Since 1990, men in the top 50% of the income distribution have had a six-year increase in life expectancy at age 65 compared with an increase of only one year for men earning below the median.

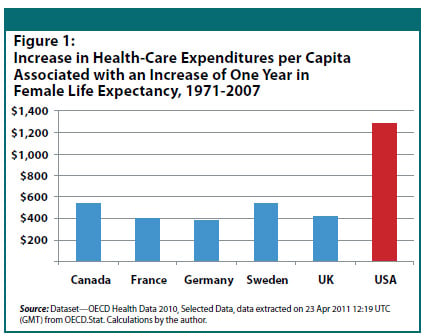

Figure 1: Increase in Health-Care Expenditures per Capita Associated with an Increase of One Year in Female Life Expectancy, 1971-2007

Rising health-care costs reflect in part the greater costs of caring for an aging population with more chronic conditions. As such, the United States looks especially bad because our population is aging less quickly than that of other countries because of high rates of immigration, relatively higher fertility, and the slower increase in life expectancy in the United States. Countries also buy higher life expectancy by spending on health care; rising health expenditures have funded improvements in treatment that have contributed to rising life expectancy throughout the world. Female life expectancy at birth has increased by nearly nine years in Germany since 1971, by over eight years in France, by seven years in Canada and the United Kingdom, and by six years in Sweden. By contrast, the United States, where female life expectancy increased by a little over five years, has done relatively poorly despite increasing health-care expenditures that dwarf those of other countries. In other countries, increasing expenditures by about $500 per person is associated with an extra year of life expectancy. With our privatized health-insurance system, we need spending increases over twice as large to gain an extra year of life (see Figure 1).

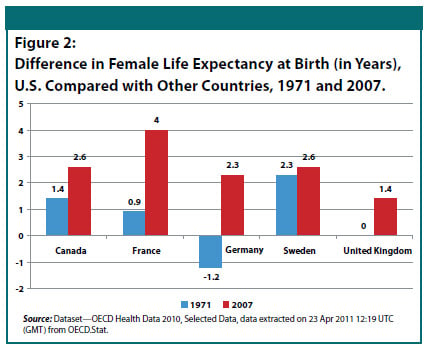

Figure 2: Difference in Female Life Expectancy at Birth (in Years), U.S. Compared with Other Countries, 1971 and 2007

The international comparison also provides another perspective on any supposed trade-off between containing costs and expanding coverage. In countries other than the United States, almost all of the increase in health-care spending as a share of national income is due to better quality health care as measured by improvements in life expectancy (see Figure 2). The problem of rising health-care costs is almost unique to the United States, the only advanced industrialized country without universal coverage and without any effective national health plan.

In short, the question is not whether we can afford a single-payer health-insurance system that would provide adequate health care for all Americans. The real question is: can we afford anything else?

Sources: Cathy Shoen, “How Many Are Underinsured? Trends Among U.S. Adults, 2003 and 2007,” Health Affairs, June 10, 2008; “Insured but Poorly Protected: How Many Are Underinsured? U. S. Adults Trends, 2003 to 2007,” Commonwealth Fund, June 10, 2008 (commonwealthfund.org); David Cutler and Dan Ly, “The (Paper) Work of Medicine: Understanding International Medical Costs,” Journal of Economic Perspectives, Spring 2011; Stephen M. Davidson, Still Broken: Understanding the U.S. Health Care System, Stanford Business Books, 2010; P Franks and C M Clancy, “Health insurance and mortality. Evidence from a national cohort,” The Journal of the American Medical Association, August 11, 1993; Allan Garber and Jonathan Skinner, “Is American Health Care Uniquely Inefficient?” Journal of Economic Perspectives, Fall 2008; Jonathan Gruber, “The Role of Consumer Co-payments for Health Care: Lessons from the RAND Health Insurance Experiment and Beyond,” Kaiser Family Foundation, October 2006 (kff.org); David Himmelstein and Steffie Woolhandler, “Administrative Waste in the U.S. Health Care System in 2003,” International Journal of Health Services, 2004; “The Uninsured: A Primer: Supplemental Data Tables,” Kaiser Family Foundation, December 2010; Karen Davis and Cathy Shoen, “Slowing the Growth of U.S. Health Care Expenditures: What are the Options?” Commonwealth Fund, January 2007 (commonwealthfund.org); “Accounting for the Cost of Health Care in the United States,” McKinsey Global Institute, January 2007 (mckinsey.com); “Investigation of Health Care Cost Trends and Cost Drivers,” Office of Massachusetts Attorney General Martha Coakley, January 29, 2010 (mass.gov); Trends in Mortality Differentials and Life Expectancy for Male Social Security-Covered Workers, by Average Relative Earnings by Hilary Waldron, Social Security Administration, October 2007; Richard G. Wilkinson, The Spirit Level, Bloomsbury Press, 2010; William Hsiao and Steven Kappel, “Act 128: Health System Reform Design. Achieving Affordable Universal Health Care in Vermont,” January 21, 2011 (leg.state.vt.us); Steffie Woolhandler and Terry Campbell, “Cost of Health Care Administration in the United States and Canada,” New England Journal of Medicine, 2003.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $41,000 in the next 5 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.