What we have here is a problem of communication. Actually, mostly that’s not true. Most of the arguments about economic policy involve real disputes about how the world works. Sometimes these are smart disputes, like the argument over the effectiveness of quantitative easing, and sometimes they’re stupid disputes, like the one over whether the Federal Reserve is debasing the currency, but, anyway, the disputes are about something real.

But to such arguments one must add an extra layer of confusion arising from the way economists use words. Fairly often, a term that is pretty deeply embedded in the professional discourse either sounds strange to outsiders or can be misinterpreted. An example of the first is the term “secular stagnation.” I know many of my readers dislike it. It relies on definition 3(c) of “secular” in Merriam-Webster’s dictionary: “of or relating to a long term of indefinite duration” — not exactly the meaning that comes to most people’s minds.

Unfortunately, that is the term economists have used for the concept since Alvin Hansen popularized it in the 1930s and 1940s, and it’s very hard to change. I suppose I could try to get a catchy alternative into circulation. I did, after all, get the “confidence fairy” out there. Maybe Sustained NEgative Equilibrium Rates of interest, or S.N.E.E.R.? I don’t know — it’s really hard to change something like this once it’s established.*

Another example is the use of the term “structural,” as in “structural unemployment.” Now, one aspect of this meaning is “hard to change.” But a fair number of people think they have found a gotcha: I’ve been denying that the United States has a big problem with structural unemployment, and now I’m saying that the country may have a sustained problem of economic stagnation. Contradiction!

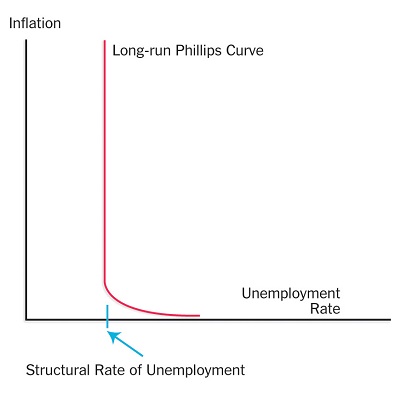

Well, no. Structural unemployment has a much more specific meaning than that. It means unemployment that can’t be eliminated just by increasing aggregate demand. It’s closely tied to the notion of a Phillips curve, a tradeoff between unemployment and inflation, which in the long run looks something like the illustration on this page. It’s almost but not quite the same thing as the N.A.I.R.U., the non-accelerating-inflation rate of unemployment — not quite, because I am now convinced that the long-run Phillips curve flattens out when inflation is low.

Well, no. Structural unemployment has a much more specific meaning than that. It means unemployment that can’t be eliminated just by increasing aggregate demand. It’s closely tied to the notion of a Phillips curve, a tradeoff between unemployment and inflation, which in the long run looks something like the illustration on this page. It’s almost but not quite the same thing as the N.A.I.R.U., the non-accelerating-inflation rate of unemployment — not quite, because I am now convinced that the long-run Phillips curve flattens out when inflation is low.

So it’s more like the minimum unemployment rate consistent with (fairly) low and stable inflation. The crucial point, however, is that’s a supply-side concept. It’s about the limits of what can be achieved by increasing aggregate demand. It has nothing at all to do with secular stagnation, which is about why increasing aggregate demand might be difficult in the first place.

One moral of the story is to beware: Economese may sound like English, but sometimes there are crucial differences. The bigger moral of the story is that, ultimately, it’s not about the words — it’s about the model.

*Brief anecdote: For historical reasons, economists involved in international macroeconomics usually measure the exchange rate as the price of foreign currency – for Mexico it’s pesos per dollar, for instance. As a result, on diagrams, when a currency goes down, the exchange rate goes up. Everyone else, including other economists, hates this convention. Yet it’s nearly impossible to change it in textbooks without upsetting thousands of course instructors.