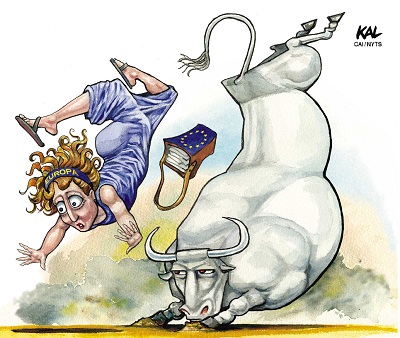

Just a few months ago Europe’s austerians were busy congratulating themselves, declaring that a modest upturn in Southern Europe vindicated all their actions. But now the news is looking grim, with industrial production stalling out and good reason to fear yet another slide into recession. This comes as many, though not all, data points in the United States are suggesting stronger growth. So why has Europe done so badly?

I’m actually not too committed to any one story here; there are arguably several factors.

First, there is fiscal austerity, which has been a very big drag. It’s important to realize, however, that the United States has also had quite a lot of de facto austerity via the federal budget sequester and state and local cutbacks. Using the International Monetary Fund’s measure of structural balances, you find that Europe has indeed tightened more relative to the United States. But it’s not as big a difference as you might think – maybe two-and-a-half points of potential gross domestic product.

You can also argue that Europe’s fundamentals are considerably worse. If you’re worried that secular stagnation might be depressing the natural real rate of interest – the rate consistent with full employment – and you think that demography is a big factor, Europe looks really terrible.

Europe really, really needs to keep inflation expectations from sliding – in fact, it almost surely needs expected inflation higher than 2 percent. However, the European Central Bank has been much less successful than the Federal Reserve at keeping expected inflation from declining.

And this reflects past policy choices and what they say about institutional biases. In the United States, Janet Yellen, the chairwoman of the Fed, and her associates have been quite clear that they are prepared to take some inflation risks on the upside in order to avoid the “nightmare scenario” of raising rates only to discover that the economy is weakening again. In Europe, however, the nightmare scenario isn’t hypothetical: It happened both in 2008 and, incredibly, in 2011. And the sadomonetarists at the Bank for International Settlements and elsewhere continue to have much more influence in Europe than they do in the United States.

I don’t believe that the current management at the E.C.B. is that different in its understanding of what policy should be doing from the leadership at the Fed. But the former has to struggle against an economy that is weaker in its underlying fundamentals, bad history and a much more powerful contingent of monetary hawks.

It really is quite scary.