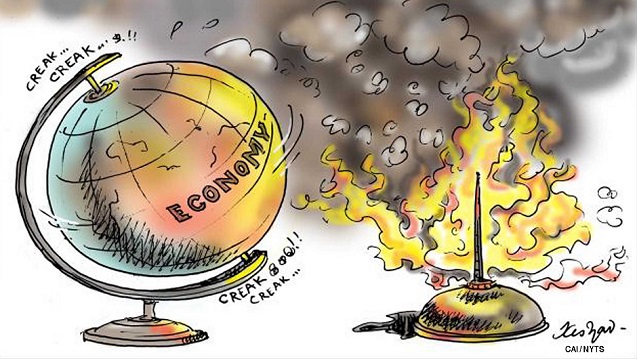

As usual, my inbox is full of speculations about when the Federal Reserve Board will raise interest rates in the United States. June 2015? Earlier? Has the Fed already waited too long? And as usual, I wonder why anyone is talking about this at all. Yes, the unemployment rate has fallen. But there is huge ambiguity about what level of unemployment is sustainable given the changing demographics, the uncertain degree to which people might return to the work force given better job availability, and so on.

There’s also a huge asymmetry in risk between raising rates too soon – which can leave us stuck in either a low-inflation or a deflationary trap for a very long time – and raising rates a bit too late, which at worst means temporarily overshooting an inflation target that’s arguably too low anyway. Meanwhile, both wages and the Fed’s preferred measure of inflation are showing no hint of an overheated economy.

So what the heck is going on?

International Mensch Fund

The International Monetary Fund recently released an audit of its own response during the aftermath of the 2008 financial crisis, which concludes that it messed up by embracing fiscal austerity in 2010. The organization failed to understand that you need to differentiate between economies that borrow in someone else’s currency and those that don’t. And it failed to appreciate that the negative effects of fiscal contraction would be much larger in a zero-lower-bound environment than historical patterns might suggest.

Well, I could have told you all of that at the time – and, in fact, I did, over and over again.

But let us nonetheless celebrate the I.M.F.’s willingness to look honestly at its own record and learn from it. Taking responsibility for your actions and statements – being a “mensch,” as my father would have said – is all too rare in modern economic discourse. The Fund, it turns out, is better than that, and deserves praise.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $50,000 in the next 9 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.