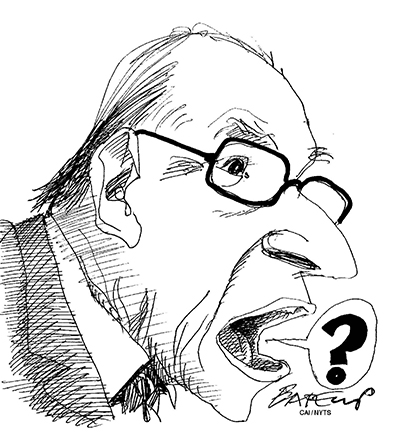

When Alan Greenspan left the Federal Reserve in 2006, he had nearly divine status in the eyes of the financial press and, I’m sorry to say, quite a few economists. Since then, of course, the former chairman’s reputation has faltered badly.

Whether or not you blame Fed policy for the housing bubble (you shouldn’t), Mr. Greenspan denied the bubble’s existence, even as it was inflating, while actively blocking efforts to tighten financial regulation.

But it’s his track record since leaving office that is truly remarkable. Mr. Greenspan has been an inflation and debt fearmonger, helping to make his successor’s already hard job even harder – and he famously complains about ungrateful markets that keep failing to deliver the crises he predicts.

After a brief moment of doubt about the wisdom of financial markets, Mr. Greenspan has gone right back to denouncing regulation, while proclaiming that markets get it right “with notably rare exceptions.”

I currently have in my inbox a notice that as the Fed holds its annual meeting in Jackson Hole, Wyo., later this year, Mr. Greenspan will address a counterconference organized by a group called the American Principles Project. The organization combines social conservatism – anti-gay-marriage, anti-abortion rights, pro-“religious liberty” – with goldbug economic doctrine.

The second half of the group’s agenda may be appealing to Mr. Greenspan, a former Ayn Rand intimate. As the late economist Paul Samuelson once remarked: “You can take the boy out of the cult, but you can’t take the cult out of the boy.”

But the antigay stuff? And helping these people attack his former colleagues at the Fed?

Awesome.

Bernanke and the Inflationistas

Ben Bernanke, the former chairman of the Federal Reserve, recently delivered a righteous smackdown of the Wall Street Journal’s editorial page: “It’s generous of the WSJ writers to note, as they do, that ‘economic forecasting isn’t easy,'” he wrote on his Brookings Institution blog. “They should know, since The Journal has been forecasting a breakout in inflation and a collapse in the dollar at least since 2006, when the [Federal Open Market Committee] decided not to raise the federal funds rate above 5-1/4 percent.”

It has taken Mr. Bernanke almost no time in his blogging career to start sounding pretty much identical to liberal econobloggers like Brad Delong – and others one might think of!

And of course Mr. Bernanke is right that The Wall Street Journal has been consistently wrong on inflation, just as it has been consistently wrong on interest rates. The Journal has spent a very long time peddling a specific kind of scare story – debt! printing presses! Zimbabwe! – that has been utterly wrong, but is never revised.

But what’s interesting here is that The Journal is far from alone in peddling this story – it’s also the staple of financial television shows and many financial publications. After all these years, there are still avid consumers of complete predictive failure.

We really need to stop pretending that this story has anything to do with rational argument. There’s something about “inflation derp” that goes straight to the ids of certain people – largely, one suspects, angry old men (though it would be nice to have hard evidence about exactly which demographic derp appeals to).

And they will keep regarding The Journal as the place to get the truth no matter how much money it costs them.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. We have hours left to raise the $12,0000 still needed to ensure Truthout remains safe, strong, and free. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.