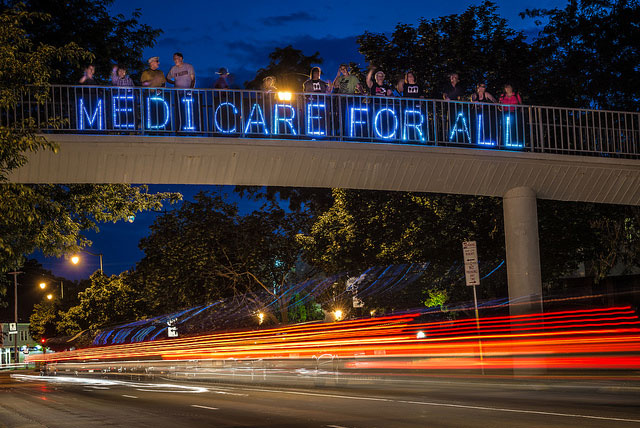

Medicare for All has quickly become a principal rallying cry for many progressives and leftists alike. Organizations ranging from Our Revolution, National Nurses United and certain branches of Democratic Socialists of America (DSA) have done much of the day-to-day work to bring single-payer health care to the forefront of political debate. Their efforts have helped push Medicare for All to the floors of the United States Senate and House. Currently, there are 16 senators and 120 Congress people cosponsoring Rep. John Conyers’ (D-Michigan) Expanded & Improved Medicare For All Act.

With greater congressional backing of Conyers’ bill and the grassroots surge in democratic socialist politics, questions have moved from the desirability to the viability of programs like Medicare for All. Partisans and opponents of social democracy alike are wondering, “Single-payer health care sounds great, but how can we pay for it? How can we pay for any universalistic program without going bankrupt?” If democratic socialists see social democracy as one of the key stepping stones towards a truly egalitarian society, the issue of how we can sustainably finance such programs is of the utmost importance.

An economic doctrine named Modern Monetary Theory (MMT) is surging in popularity and offering answers. MMT is debunking popular narratives about the harsh necessity of austerity and belt-tightening. It is showing that money is not a finite abstraction, but a limitless public utility that can be used to meet human needs. More than this, however, MMT and its heterodox economic cousins offer a framework to build directly democratic, egalitarian political structures, and thus reimagine and recalibrate the viability of democratic socialism.

What Is MMT? Understanding Neo-Chartalism

One of the theoretical forerunners and bases of MMT is chartalism, an economic theory which argues that money is a creature of the state designed to direct economic activity. The theory has recently been popularized by David Graeber’s book Debt: The First 5,000 Years, a wide-ranging work that touches upon issues ranging from gift economies, the linkage between quantification and violence, and the relationship between debt and conceptions of sin. In charting out the history of money, Graeber notes that, despite anthropological evidence to the contrary, economists have long clung to the myth of barter.

However, money does not emerge from barter-based economic activities, but rather from the sovereign’s desire to organize economic activity. The state issues currency and then imposes taxes. Because citizens are forced to use the state’s currency to pay their taxes, they can trust that the currency will carry value in day-to-day economic activities. Governments with their own currency and a floating exchange rate (sovereign currency issuers like the United States) do not have to borrow from “bond vigilantes” to spend. They themselves first spend the money into existence and then collect it through taxation to enforce its usage. The state can spend unlimited amounts of money. It is only constrained by biophysical resources, and if the state spends beyond the availability of resources, the result is inflation, which can be mitigated by taxation.

These simple facts carry radical policy implications. Taxes are not being used to fund spending, but rather to control inflation and redistribute income (and Trump’s tax plan is certainly continuing the redistribution of income upward). Thus, we can make the case for progressive taxation from a moral standpoint concerned with social justice: We should tax rich people because their wealth is the product of exploitation and an affront to any truly democratic society, not because our transitional political program depends upon it. Congress can simply authorize the Treasury and the Federal Reserve to spend the money necessary for single-payer health care.

If we apply MMT to Medicare for All, the aforementioned “viability” debate and ungrounded fears about “printing money” fades into the background. Rather, our concerns shift toward examining our available resources and thinking about how to best provision them in such a way to as to advance social justice. This means training doctors, nurses and other medical practitioners. And it also means medical facilities being supplied with the necessary instruments, tools and technologies to provide care and treatment to patients and their communities.

This carries implications for policymaking beyond Medicare for All. If money belongs to the public, then questions about who and what the public is will arise. By extension, money, financing and investment should be subject to popular control through directly democratic participatory processes. To operationalize policies, however, requires further insights from heterodox thinkers close to MMT like lawyer Adolph Berle and economists Gardiner Means and Alfred Eichner.

Management, Not Ownership

Heterodox economics is a broad economic category referring to schools of thought that dissent from the dominant Keynesian or neoclassical economics. Like MMT, these schools not only revised prevailing paradigms about money, but also questioned common assumptions about things like the role of uncertainty, the principle of effective demand and the importance of social structures like class in economic analysis.

Many of these alternative thinkers began to make their splash in the early 20th century. In their book The Modern Corporation and Private Property, lawyer and economist Berle and Means make an important distinction between ownership and management especially relevant to deeply unequal economic environment of the Great Depression. They note that in Adam Smith’s private corporation, ownership and control were combined. No more than a few individuals owned a piece of private property and used their own labor to maintain and improve its value. This was no longer the case in the 20th century US. Instead, the public used the open market to invest in — and thus partially own — corporations. Such ownership was “passive.”

Passive ownership was hugely different than what Berle and Means deemed “active ownership.” After all, the owner of a horse has an active interest in making sure the horse lives, whereas the owner of stocks — or mere “pieces of paper” representing ownership in a company — implies fundamentally different responsibilities. After all, it is simply impossible for stockowners to attend all shareholder meetings and vote on company-related issues, so they delegate their voting responsibilities to a proxy. Often, control was exerted not by the already distant managerial class, but by even more distant individuals. Through pyramiding, individual capitalists extend their majority ownership in one company to majority ownership in numerous other companies. These are other companies that individual capitalists only had small ownership in. Yet, through one company (as opposed to formally one individual) possessing controlling-shares in another company, corporate control ends up being increasingly concentrated.

Logically then, undemocratic control of the firm meant undemocratic control over how the firm sets its prices. In his book The Megacorp and the Oligopoly: Micro Foundations of Macro Dynamics Megacorp and the Oligopoly: Micro Foundations of Macro Dynamics, post-Keynesian economist Eichner notes that prices are not set by supply and demand forces, but rather administered by the firm itself. Eichner notes that the price leader (i.e. the most powerful corporation) sets the price, other firms follow, and new prices are only set when the designated pricing period ends and after firms have had sufficient time to deliberate with one another. This is why prices remain fairly constant over long periods of time despite fluctuations in supply and demand.

Administered pricing power carries immense consequences for macroeconomic health. By suddenly raising prices — like U.S. Steel famously did in 1961 — megacorps can affect inflation and affect a country’s economic interests. It was in this context that Eichner called for megacorps to be regulated. However, Eichner knew that humane policy would go beyond just curbing inflation, which he thought could be achieved by a simple price freeze. He knew that workers had to be confident that the megacorp would not abuse its pricing power and create an oligarchy.

Thus, in attempting to expand economic democracy, Eichner’s overarching goal was to establish “social control” over the megacorp’s investment decisions (a process intimately related to price administration). He states that it is imperative to:

“[G]ive the trade unions, as well as other groups in society, a greater voice in determining [social control over the megacorp]. … The various groups need to be brought together in a social and economic council where the implications of [investment decisions] can be discussed and some sort of consensus reached. … The [most] important condition, however, is that the consensus reached by the social and economic council, assuming the council were a sufficiently representative body, become the basis for government policy…”

In other words, Eicher believes that the role of labor unions is not just to bargain for bread-and-butter issues like wage increases, but to exert significant influence over the economic decisions affecting society at large. When coupled with democratic-socialist discourse and imperatives, the insights offered by these thinkers lead to timely options to intervene in policy-making and think about how to achieve social control.

Policies for a Neo-Chartalist Democratic Socialism

When coupled with democratic socialism, Berle, Means and Eichner all inspire a praxis of worker self-management and participatory democracy. Grasping nuanced divisions between ownership, management and control allows democratic socialists to better understand that solely changing ownership structures will not necessarily create a democratic, egalitarian society.

After all, minority ownership blocs represented by proxy managers or pyramided individuals can often exert almost complete control over the firm. The US has numerous firms with Employee Stock Ownership Plan status that are 100 percent employee-owned, but have board of directors that are not elected by workers themselves. In a global context, such worker alienation has also occurred in purportedly socialist countries, too. In his seminal book Labor and Monopoly Capital, Harry Braverman quotes an American sociologist visiting the Soviet Union who noted that the “Soviet economists and social scientists [he] met in Moscow … insisted that job satisfaction studies are irrelevant in a society in which the workers own the means of production.” This view suggests that things like worker participation in management decisions and day-to-day affairs are simply unimportant — equal distribution of ownership certificates alone guarantees the promises of socialism.

To counter this distressing vision, we as individual members of Democratic Socialists of America call forth a vision of maximal democracy that can be operationalized through a heterodox economics framework. We envision a democratic socialism with four policies at its core that each appeal to distinct constituencies:

- Medicare for All: All would have universal access to health care, with a structure that also allows for effective input by patients, medical practitioners and other stakeholders.

- Multi-Stakeholder and Workers’ Self-Managed Job Guarantee: The state creates unemployment by imposing a monetary survival-constraint through various financial obligations (such as taxes, duties, fees, fines, etc.). One partial but significant solution to unemployment issues is that a job be offered to anyone who wants one. Yet, for democratic socialists, this job must approximate from and towards socialist relations of production — rather than hierarchical exploitative relations of production, as was common under many prior experiments in state-socialism.

- Financing Enterprise Conversions to Democratic Employee-Ownership: Due to a wave of 2.34 million retiring Baby Boomer small business owners, nearly 25 million workers could lose their jobs over the next 10 years. What would otherwise amount to a crisis could amount to an opportunity to save jobs and create millions of enterprises that operate according to “one worker, one vote.” Furthermore, soon-to-be retirees would have be given financial exit options that preserves their legacy and can only amount to an extension of community.

- Free Public University: Degrees and certifications are increasingly structuring employment. As MMT demonstrates, the issue is not one of fiscal means, but technical. The casualization of academic labor shows there rapidly growing pool of educators available to meet the growing desire for university instruction.

Unlike the claims of Soviet economists and social scientists, job satisfaction surely is important if one wants to create a truly democratic socialist society. And such a society will only exist if workers not only own the means of production, but also have control in and through the management of their workplaces and lives at large. MMT and heterodox economics paves the path forward for us to get there.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $46,000 in the next 7 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.