How do you assess stories about what’s going on in the economy? You can go with your prejudices, of course. You can turn to detailed econometric evidence — although in my experience, essentially nobody, including the econometricians, is convinced by that sort of thing. But the way I usually try to do it is to ask whether the available facts fit the “signature” that the story seems to imply — that is, do we see the general pattern that the argument would suggest we’d see?

Now consider the argument that our problems are mainly structural. The way this story is usually told is that we had too many workers in the wrong industries in the United States — that we have to expect a depressed level of overall employment as workers are moved out of these “bloated” sectors. O.K., so what should be the signature of that story? Surely it is that job losses should be concentrated in the bloated sectors, that employment should if anything be rising elsewhere — and wages should be rising in the unbloated sectors more rapidly than in the bloated ones.

Now consider the argument that our problems are mainly structural. The way this story is usually told is that we had too many workers in the wrong industries in the United States — that we have to expect a depressed level of overall employment as workers are moved out of these “bloated” sectors. O.K., so what should be the signature of that story? Surely it is that job losses should be concentrated in the bloated sectors, that employment should if anything be rising elsewhere — and wages should be rising in the unbloated sectors more rapidly than in the bloated ones.

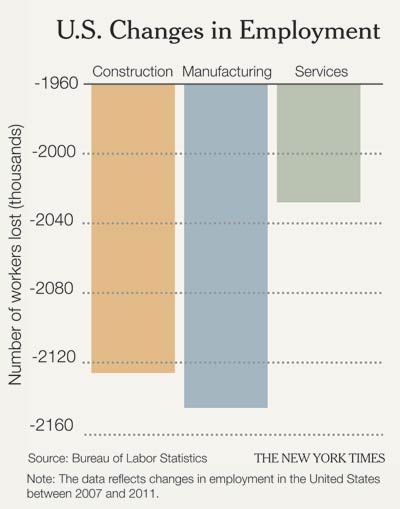

So, let’s take a quick look at data from the Bureau of Labor Statistics on employment and wages. The chart on the left is what we get on a first pass. Kind of looks like job losses everywhere, doesn’t it? And on wages, see the chart at bottom. Who’s bidding for workers? You can try to refine this stuff by disaggregating, but on first pass the signature of a structural problem just isn’t there. (And trust me, a closer look doesn’t do much better). Or maybe people have some other structural story in mind — except that’s the one they like to tell in popular articles.

So why are these people so sure that it’s structural? I know that it sounds wise and Serious to say that it is, but there is this matter of actual evidence; that evidence is strongly inconsistent with a structural story, and quite consistent with a demand story. That doesn’t settle the case entirely, but in a better world it would go a long way toward resolving the argument. Too bad we don’t live in that better world.

So why are these people so sure that it’s structural? I know that it sounds wise and Serious to say that it is, but there is this matter of actual evidence; that evidence is strongly inconsistent with a structural story, and quite consistent with a demand story. That doesn’t settle the case entirely, but in a better world it would go a long way toward resolving the argument. Too bad we don’t live in that better world.

Structural Flashbacks

A few notes regarding the renewed push by conservatives to declare our problems “structural,” or not solvable just by increasing demand.

1. That’s what Very Serious People said in the 1930s, too. Then the approach of war finally delivered the stimulus we needed, and all those structural difficulties turned out to be imaginary.

2. Ireland was praised for its wonderful flexibility; it was a shining example of the art of the possible, declared George Osborne, then Britain’s shadow chancellor of the Exchequer. Then, when things went wrong, Ireland was told that it must fix its deep structural rigidities.

3. Anyone who says something like, “If deficit spending were the route to prosperity, Greece would be in great shape,” should be immediately considered not worth listening to. People in my camp have repeated until we’re blue in the face that the case for fiscal expansion is very specific to circumstance — it’s desirable when you’re in a liquidity trap, and only when you’re in a liquidity trap. I know that some people like to project their own crudity onto others, but what they’re actually demonstrating is their own ignorance.

4. Anything along the lines of “we need long-run solutions, not short-run fixes” may sound sophisticated, but it’s actually just the opposite. Take it away, John Maynard Keynes: “But this long run is a misleading guide to current affairs. In the long run we are all dead,” he wrote in 1923. “Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again.”

© 2012 The New York Times Company

Truthout has licensed this content. It may not be reproduced by any other source and is not covered by our Creative Commons license.

Paul Krugman joined The New York Times in 1999 as a columnist on the Op-Ed page and continues as a professor of economics and international affairs at Princeton University. He was awarded the Nobel in economic science in 2008. Mr Krugman is the author or editor of 20 books and more than 200 papers in professional journals and edited volumes, including “The Return of Depression Economics” (2008) and “The Conscience of a Liberal” (2007).

Copyright 2012 The New York Times.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $27,000 in the next 24 hours. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.